JANA’s Track Record As an Activist Investor

Activist investor JANA Partners sold a 20% stake in the firm to Neuberger Berman’s Dyal Capital Partners. Dyal holds a passive interest in JANA Partners.

Aug. 18 2020, Updated 5:14 a.m. ET

JANA Partners’s new target is CSC

Recently, JANA Partners revealed an increased stake of 5.9% in Computer Sciences Corporation (CSC) via a 13D filing with the SEC. Computer Sciences Corporation is an information technology and services company. The fund, which is known for its activist stance, is pushing CSC to explore strategic alternatives such as a merger or a sale. CSC has been undergoing a transition under CEO Mike Lawrie.

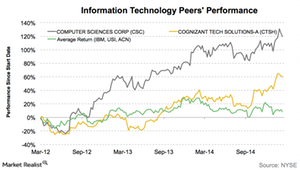

While the stock has outperformed industry peers such as Cognizant Tech Solutions (CTSH), International Business Machines (IBM), Unisys (UIS), and Accenture (ACN), its revenue in the last two quarters has fallen short of estimates. CSC has a 0.26% exposure to the iShares US Technology ETF (IYW), which includes companies in the US electronics, computer software and hardware, and informational technology spaces.

JANA as an activist investor

Founded by Barry Rosenstein in 2001, New York-based JANA Partners manages around $11 billion in investments. It specializes in value-oriented, event-driven investing. The fund applies a fundamental value approach to identify undervalued companies, and it then works with the company’s management to push for change. JANA Partners invests in both equity and debt.

Other companies that have been subject to JANA’s activism include PetSmart, Civeo, Walgreen, Hertz Global Holdings, Apache, and URS Corp.

In October 2014, Civeo Corp. (CVEO) agreed to give three independent board seats to JANA. After JANA’s push, the specialty pet supplies retail chain PetSmart (PETM) agreed to be acquired by a group led by BC Partners. Supermarket chain Safeway (SWY) also agreed to a sale after an activist investment by JANA.

An overview of the fund’s 4Q14 filings revealed that JANA sold off its activist stakes in companies connected to the energy sector, including Apache Corporation (APA), Civeo, QEP Resources (QEP), Cameron International Corporation (CAM), and Gulfport Energy (GPOR).

A Wall Street Journal report noted that JANA’s flagship fund gained 3.71% in 2014, while the Nirvana fund saw returns of 5.84%.

JANA sells 20% stake to Dyal

A March Wall Street Journal report said that JANA Partners sold a 20% stake in the firm to Neuberger Berman’s Dyal Capital Partners. According to Dyal, JANA is valued at $2 billion. Dyal holds a passive interest in JANA Partners and will not interfere in JANA’s operations. Dyal is a New-York based private equity firm that actively invests in hedge funds. JANA noted, “This investment will result in significantly enhanced, top to bottom alignment with our investors.”

It will be interesting to see how JANA will deal with CSC’s management for the proposed strategic alternatives. In the following parts of this series, we’ll discuss CSC’s businesses in more detail.