Safeway Inc

Latest Safeway Inc News and Updates

Healthcare Farallon Capital adds a new position in Covidien

Ireland-based Covidien is a global healthcare leader that offers innovative medical technology solutions and patient care products to providers.Financials Why credit upgrades and downgrades affect bond returns

A ratings upgrade or downgrade has a direct impact on fixed income yields, and therefore directly affects bond prices.

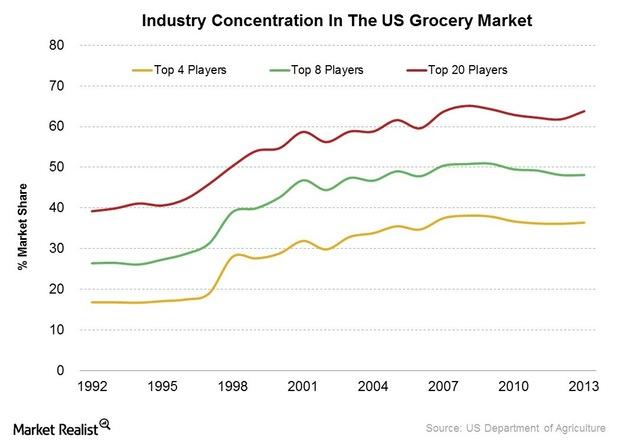

Competitive Forces: Why Walmart Dominates The Grocery Industry

Walmart’s largest merchandising category is groceries. According to the USDA, Walmart was the largest seller of grocery items in the US in 2013.

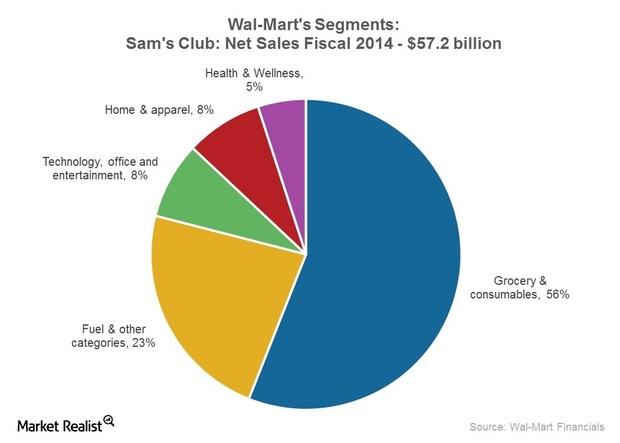

Walmart’s Sam’s Club Segment: Positioning For The Next Level

Walmart’s Sam’s Club segment consists of membership-only club warehouse retail operations. Members include both business owners and individual consumers.