Cameron International Corp

Latest Cameron International Corp News and Updates

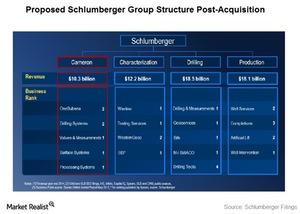

Schlumberger and Cameron International: a Complementary Team

Schlumberger and Cameron are contemplating a merger because their drilling and production systems would be integrated from “pore to pipeline.”Financials Omega Advisors buys stake in IntercontinentalExchange

Omega Advisors opened a new 1.36% position in Intercontinentalexchange (ICE), a leading operator of global markets and clearing houses, in the fourth quarter.

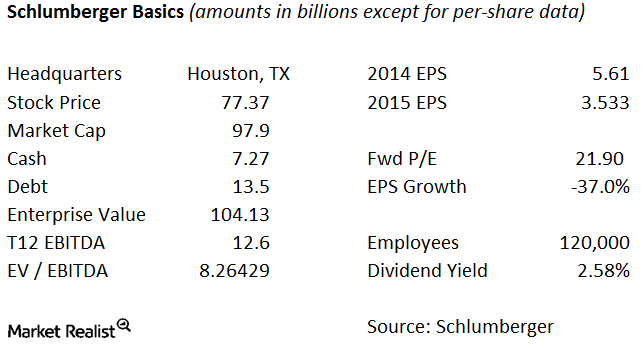

Basics of Schlumberger

Schlumberger (SLB) provides technology, project management, and information technology services to the oil and natural gas exploration and production industry.