Cognizant Technology Solutions Corp

Latest Cognizant Technology Solutions Corp News and Updates

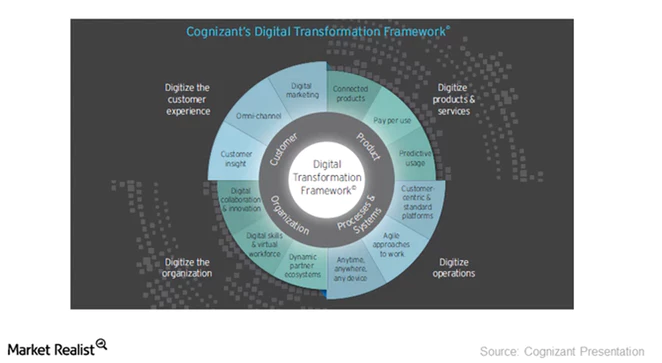

A Look at Cognizant’s Focus on Digital Transformation

To lead the global digital transformation effort, Cognizant (CTSH) is providing solutions to transform businesses’ operating and technology models.

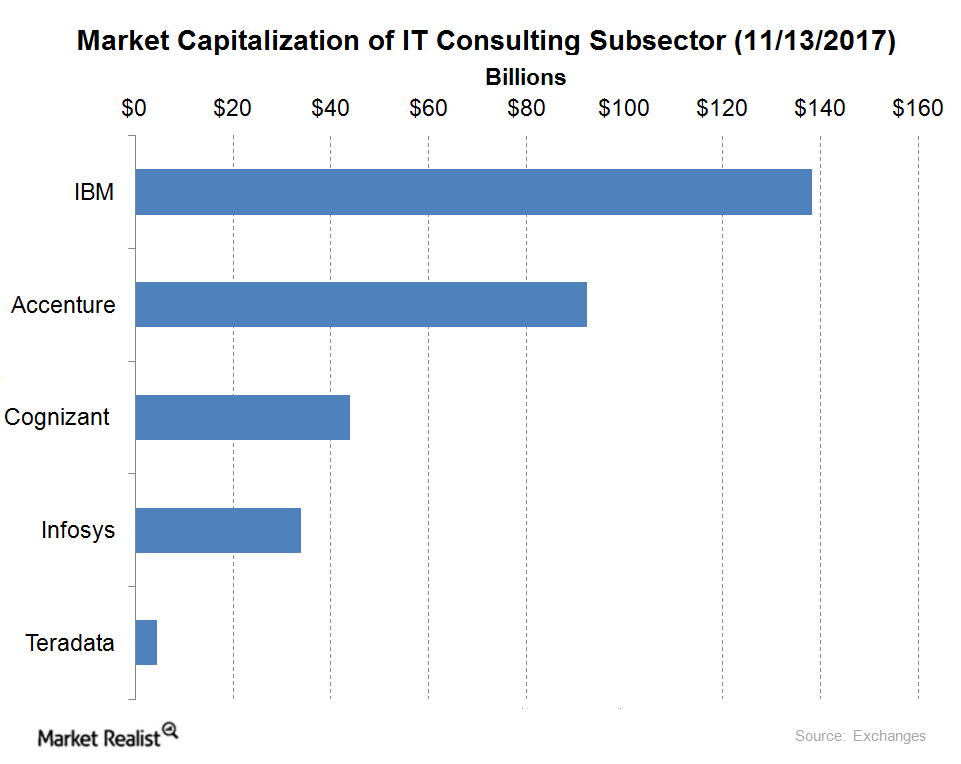

Understanding IBM’s Value Proposition in the IT Consulting Space

IBM was trading at a forward EV-to-EBITDA multiple of ~9.25x on November 11, 2017.

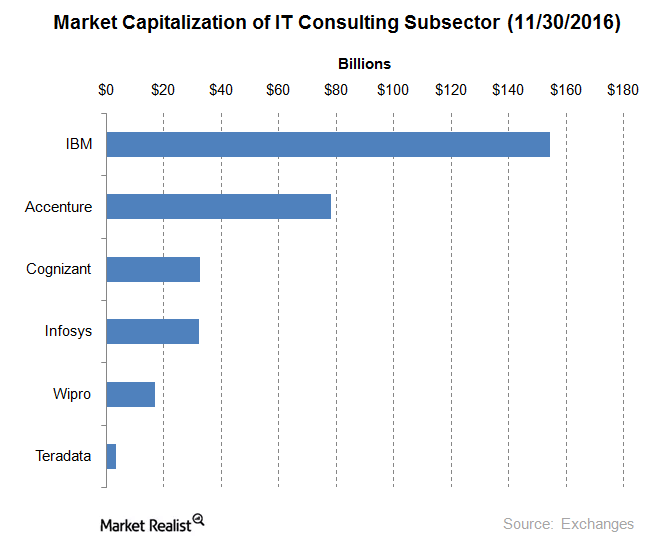

Understanding Cognizant’s Value Proposition in the IT Consulting Space

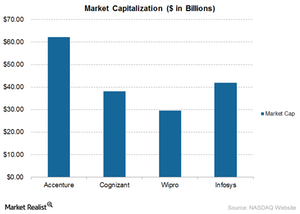

On November 30, IBM was the largest player by market capitalization in this space, followed by Accenture. Cognizant (CTSH), Infosys, Wipro, and Teradata.

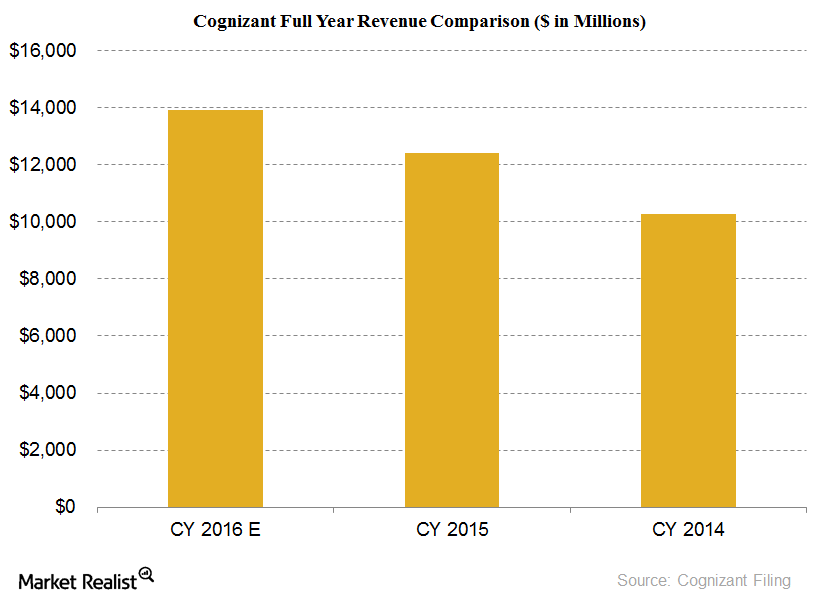

How Cognizant Hopes to Increase Market Share in 2016

Cognizant’s (CTSH) revenues in 2015 rose by an impressive 21% to $12.4 billion from $10.3 billion in 2014.

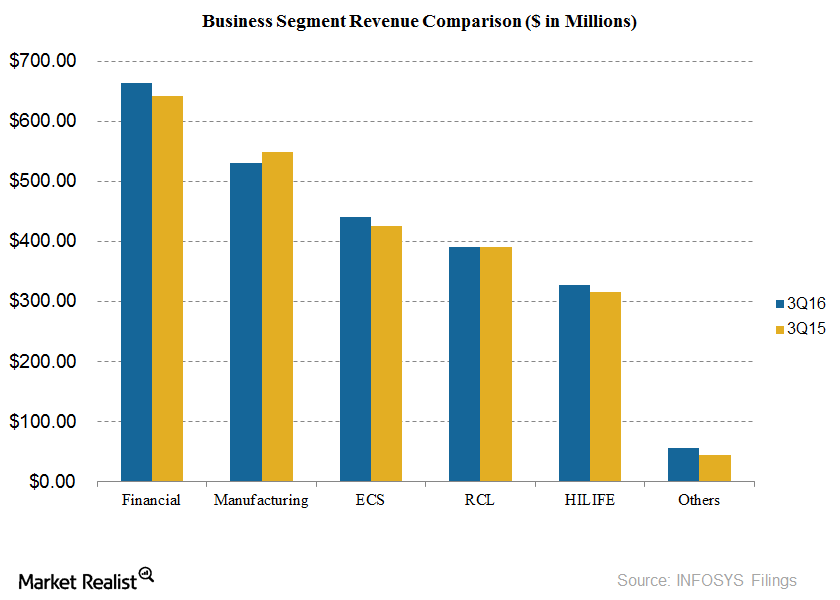

Infosys Revenues by Segment: Financial Services Take the Lead

Revenues from the financial services segment of the India-based (EPI) Infosys (INFY) were $663 million in fiscal 3Q16. This is 27.5% of total revenues.

Introducing Accenture, the Largest Global IT Consulting Firm in Revenues

Accenture is one of the world’s largest multinational technology services, management consulting, and outsourcing companies and is headquartered in Dublin.