Highlights of Fairholme Capital’s 4Q14 Portfolio

Fairholme Capital’s collective funds hold in excess of ~$7.0 billion in net assets, of which roughly 94% is concentrated in FAIRX.

Nov. 20 2020, Updated 12:41 p.m. ET

Fairholme Capital

Founded by Bruce Berkowitz in 1997, Fairholme Capital Management is a pooled investment vehicle that employs long-term, value-oriented investing. Bruce Berkowitz has a proven track record for investing in undervalued stocks that trade below their fair intrinsic value. He holds onto those securities until their market prices demonstrate a correction toward their fair value.

Fairholme Capital carries out its investments through three funds:

- The Fairholme Fund (FAIRX), which targets long-term capital growth

- The Income Fund (FOCIX), which focuses on investments that provide steady current income

- The Allocation Fund (FAAFX), which seeks long-term total return

Collectively, these funds hold in excess of ~$7.0 billion in net assets, of which roughly 94% is concentrated in FAIRX. Since its inception in 2000, FAIRX has delivered an average annual return of 11.83% versus the S&P 500’s 4.27% for the same period.

4Q14 highlights

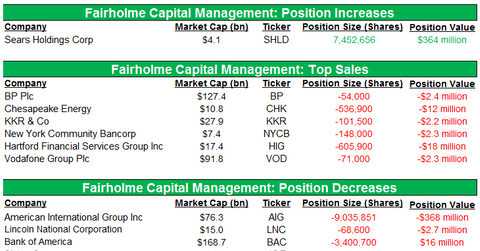

In 4Q14, Fairholme’s US long portfolio size remained steady at $7.3 billion. The fund added new positions in Sears Canada (SRSC) and Canadian Natural Resources (CNQ). It also increased its stake in Sears Holdings Corp (SHLD) by ~7.4 million shares.

Bruce Berkowitz’s fund exited stakes in several companies, including BP Plc (BP), Chesapeake Energy (CHK), KKR & Co. (KKR), New York Community Bancorp (NYCB), Hartford Financial Services Group (HIG), and Vodafone Group (VOD).

Notable position decreases were American International Group (AIG), Lincoln National Corporation (LNC), Bank of America (BAC), The St Joe Co. (JOE), and Leucadia National Corp. (LUK).

Top positions

As indicated in the table above, the fund’s top positions were in companies that belonged to the financial services sector, including American International Group (AIG), Bank of America (BAC), Berkshire Hathaway (BRK-B), JPMorgan Chase (JPM), and Wells Fargo (WFC), which collectively made up 73% of the portfolio size.

Investors seeking to gain exposure to the financial services sector can consider investing in the Financial Select Sector SPDR Fund ETF (XLF). XLF’s top four positions include BRK-B, with a portfolio weighting of 9.18%; WFC, with 8.34%; JPM, with 7.46%, and BAC, with portfolio weightings of 5.95%.