Canadian Natural Resources Ltd

Latest Canadian Natural Resources Ltd News and Updates

What Are the Best Canadian Energy Stocks to Buy in September?

Energy prices are expected to rise more in 2021. What are the best Canadian energy stocks that you can buy in September?

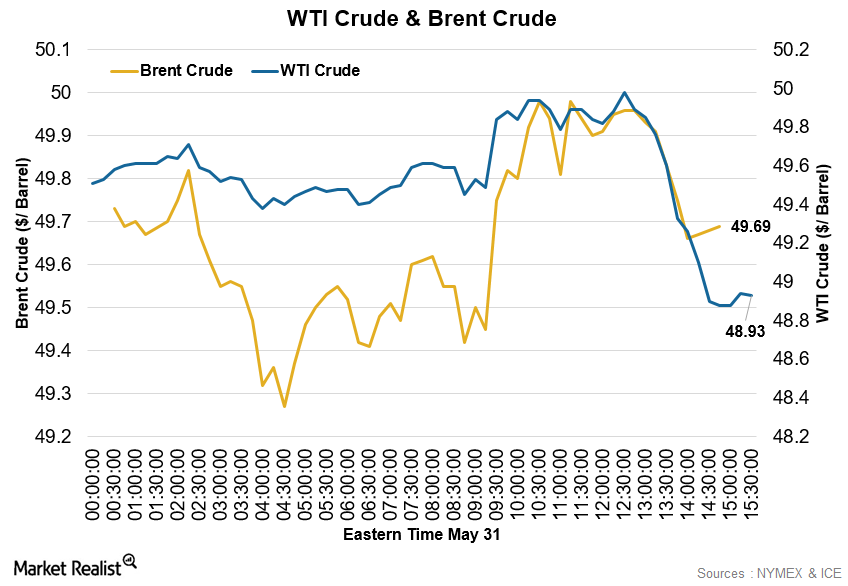

How Did Crude Oil Perform on Tuesday, May 31?

Crude oil had a volatile trading day on Tuesday, May 31, 2016. At 1:40 PM EDT, WTI crude for July delivery traded at $49.67 per barrel, a gain of 0.67%.