Cushion Volatility With Bonds

High yield bonds are becoming increasingly correlated with the S&P 500 and might increase your risk exposure instead of giving diversification benefits.

March 20 2015, Updated 2:05 p.m. ET

Help cushion volatility with bonds.

It’s true that the volatility of cash is low, but there are other ways to potentially bring down volatility in a portfolio: adding bonds is one option.

Consider this simple example with a three-instrument portfolio comprised of a S&P 500 ETF (IVV), a long-term bond ETF (TLT) and a cash-proxy ETF. Based on daily returns since 2010, the annualized volatility on the cash proxy (a short-term bond ETF) is effectively zero, compared to 16% and 15% for the stock and bond ETFs. A quick glance at these numbers seems to suggest that the best way to dampen portfolio volatility is to hold a lot of cash, but this conclusion ignores the important diversification benefits of bonds.

For the past five years or more, bonds have had a strongly negative correlation with stocks; in this environment, adding bonds to a stock-heavy portfolio now is highly diversifying. Unless you have an unusually low risk tolerance, an outsized cash allocation is rarely optimal.

Market Realist – Losing out on returns and income is indeed the biggest disadvantage of holding cash and might be a big price to pay for bringing down volatility (VXX). If volatility and uncertainty is preventing you from entering the equity markets, investing in bonds is a good option. The above graph from BlackRock shows the correlation between 10-year US Treasuries (TLT) (IEF) and the S&P 500 from 1900–2014.

Government bonds are often called safe-haven assets because they perform well during periods of downturn for equities. Correlations between US stocks and bonds have remained negative for most of this timeframe, as can be seen above, and are currently at new lows. This means that when equities prices fall, bond prices increase and vice versa.

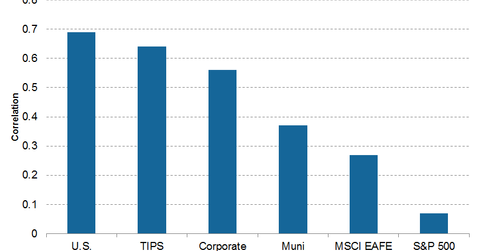

The previous graph shows the correlation of US Treasuries with the S&P 500 (SPY), the developed markets (EFA), and emerging markets (EEM). The low correlation of Treasuries with all these asset classes make them a good diversifier.

Investors need to be careful of high yield bonds (HYG), which are becoming increasingly correlated with the S&P 500. Hence, adding high yield bonds to your portfolio might actually increase your exposure to more risk instead of giving diversification benefits.

Investors could also look at including gold (GLD) and gold miner ETFs (GDX) in their long-term portfolios to take advantage of diversification benefits. The correlation of gold with the S&P 500 has been low, especially in the last five years. Even though gold has been skimming the troughs in 2015, it is still a good long-term opportunity.

Investors could also consider investing in municipal bonds, infrastructure debt, and core-real estate (IYR) to diversify their long-term portfolios.