The EIA natural gas inventory report: Why should I care?

Natural gas inventory levels have a direct bearing on natural gas prices, which in turn affect the profitability of natural gas producers.

Feb. 3 2015, Updated 12:26 p.m. ET

Natural gas inventories

The U.S. Energy Information Administration (or EIA) reports natural gas inventory figures every week. Natural gas is an important fuel worldwide with a wide range of uses, from power generation to plastics.

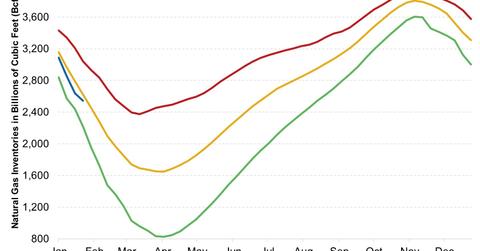

Natural gas consumption in the United States is very seasonal. Consumption is highest in the winter when heating demands are at their highest. About half of American households heat with natural gas. Storage levels decline during these months. The period between April 1 and October 31, also called the injection season, is when producers restock natural gas storage.

Demand and inventories

Markets monitor inventory levels every week to determine if inventory levels will be high enough for the winter. If the winter demand is strong, available stored natural gas could come under strain.

While natural gas demand is high during the winter, high temperatures during the summer can also cause demand to increase. Power stations use more fuel to power cooling devices such as air conditioners. This sometimes reduces storage buildup during the injection season.

Inventories and prices

Natural gas inventory levels have a direct bearing on natural gas prices, which in turn affect the profitability of natural gas producers such as Range Resources (RRC), Devon Energy (DVN), Encana Corporation (ECA), and Chesapeake Energy (CHK). All these companies are components of the Energy Select Sector SPDR ETF (XLE).

When there are supply constraints because of strong heating demands, particularly during the winter, natural gas prices can spike.

This is what happened last winter when heating demand was at its highest. Natural gas prices touched $6 per MMBtu (million British thermal units).

Later in this series, we’ll discuss recent natural gas price movements.

Inventory expectations

If a decline in inventories exceeds expectations, it implies either lower supply or stronger demand than expected. This is bullish for natural gas prices. However, if the decrease in natural gas inventories is less than expected, it implies either stronger supply or lower demand than expected. This is bearish for natural gas prices.

Analysts expected an inventory draw of 111 billion cubic feet (or bcf) last week. We’ll discuss actual inventory changes in the following part of this series.