Who’s the energy company achiever, and who are the laggards?

Let’s see which energy company stands out as the most efficient in reducing debt loads and improving leverage ratios and which ones are laggards.

Dec. 4 2020, Updated 10:43 a.m. ET

Finding the metrics

So far in this series, we’ve looked at each of the eight upstream energy companies and two integrated oil and gas majors. In this article, we’ll find out which energy company stands out as the most efficient in reducing debt loads and improving leverage ratios. We’ll also see which ones have deteriorated along these metrics.

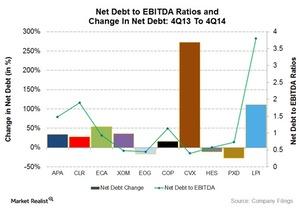

We’ve ranked these companies based on the following two metrics:

- net debt, or long-term and short-term debt less cash reserves

- net debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio

Using these metrics, we’ll identify the laggards, the middlings, the front-runners, and the achiever among these energy companies.

Chevron keeps leverage ratio down despite debt surge

Between the two integrated companies we’ve looked at in this series, Chevron Corporation’s (CVX) net debt increased the most in the past one year. From 4Q13 to 4Q14, Chevron’s net debt increased 272%, to $14.6 billion. Its net debt to EBITDA ratio at 0.40x, however, is slightly lower than Exxon Mobil’s (XOM) at 0.47x. Exxon Mobil (XOM) increased its net debt by 36% to $24.5 billion in the past one year.

In 2014, Chevron Corporation (CVX) recorded $36.5 billion EBITDA, which kept its leverage ratio down. In comparison, Exxon Mobil’s (XOM) EBITDA in 2014 was $56.0 billion.

The laggards

- Laredo Petroleum (LPI). Laredo Petroleum’s net debt-to-EBITDA ratio is the highest, at 3.79x, among the energy upstream companies we’ve looked at in this series. Its net debt has increased the most among its peers from 4Q13 to 4Q14, by 111%.

- Continental Resources (CLR). Continental Resources’ net debt-to-EBITDA ratio is one of the highest, at 1.89x, among the energy upstream companies discussed here. In the past four quarters, its net debt increased 27%, which is higher than the group average.

- Apache Corporation (APA). Apache Corporation’s net debt-to-EBITDA ratio is on the higher side, at 1.48x. Its net debt has increased by 34% in the past four quarters, higher than the peer average.

The middlings

- ConocoPhillips (COP). ConocoPhillips’ net debt-to-EBITDA at 1.13x is lower than the group average. Its net debt, however, increased at a moderate rate of 15.6% in the past one year.

- Encana Corporation (ECA). Encana Corporation’s net debt-to-EBITDA at 0.93x is lower than the group average. Its net debt, however, increased at a relatively higher rate of 53.6% in the past one year.

The front-runners

- Pioneer Natural Resources (PXD). Pioneer Natural Resources’ net debt-to-EBITDA at 0.73x is much lower than the group average. The company was able to decrease net debt by ~27% in the past one year.

- Hess Corporation (HES). Hess Corporation’s net debt-to-EBITDA at 0.57x is the second lowest in the group. In the past one year, its net debt decreased 11%.