Why you should invest in homebuilder ETFs like XHB and ITB

ETFs present another investment avenue. Apart from pure homebuilder ETFs, there are many other ETFs that offer exposure to homebuilders.

Nov. 20 2020, Updated 3:47 p.m. ET

ETFs: An alternative investment option

While you can invest in any of the homebuilders stocks that we’ve discussed throughout this series, ETFs (exchange-traded funds) present another investment avenue. ETFs offer investors a proportionate share in a pool of stocks, bonds, and other assets.

There are various sector-specific ETFs available in the market—including homebuilders ETFs, which are designed for investors who want to focus on the construction sector of the residential real estate. This approach can help spread out your assets among a wide variety of companies and reduce company-specific risk for a very low cost.

There aren’t many homebuilder ETFs available for investment—but there is some diversity in the funds that are available.This diversity gives you some choice when you’re picking a homebuilder ETF. We’ll cover some prominent ETFs that are worth looking at.

The SPDR S&P Homebuilders ETF (XHB)

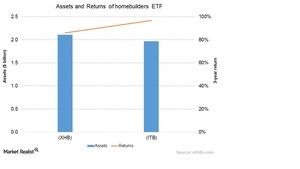

This ETF is from State Street Global Advisors. It correlates with the S&P Homebuilders Select Industry Index. It has total assets of $2.10 billion, a market cap of $1.86 billion, a dividend yield of 0.52%, and an expense ratio of 0.35%. The fund’s main focus is homebuilding companies, and some of the fund’s top holdings are PulteGroup (PHM), with 3.2% of the fund, and MDC Holdings, with 3.22%.

The iShares Dow Jones US Home Construction ETF (ITB)

This ETF from iShares tracks the Dow Jones US Select Home Construction Index. It has total assets of $1.94 billion, a market cap of $1.85 billion, a dividend yield of 0.42%, and an expense ratio of 0.45%. Some of the top holdings in this fund are DR Horton (DHI), at 10.85%, and Lennar (LEN), at 10.37%.

Other industry ETFs

Apart from pure homebuilder ETFs, there are many other ETFs that offer exposure to homebuilders. The SPDR KBW Mortgage Finance ETF (KME) has exposure of 1.93% in Lennar (LEN) and 2.24% in D.R. Horton (DHI). Similarly, the S&P 500 Pure Growth ETF (RPG) has exposure of 2.33% to Lennar (LEN) and 2.46% to D.R. Horton (DHI).

The other types of ETFs are those with considerable exposure to the sectors that directly relate to the housing industry. For example, think financials and consumer goods such as furniture, home appliances, and lawn and garden supplies. Financial ETFs to watch include the Vanguard Mortgage Backed Securities ETF (VMBS) and the iShares Barclays MBS Fixed-Rate Bond Fund (MBB). Similarly, consumer discretionary ETFs that you should track include the Vanguard Consumer Discretionary ETF (VCR) and the SPDR Cons Discretionary Select Sector Fund (XLY).

What next?

Every month, the government and other bodies come out with lot of data on housing. These releases influence homebuilder stocks and ETFs. In my next series, we’ll analyze several vital housing indicators and their impact on homebuilder stocks and ETFs.