Why Chevron is cutting spending on some projects

Chevron has cut spending on the Kitimat liquefied natural gas project (or LNG) in Canada due to falling crude prices.

Dec. 4 2020, Updated 10:53 a.m. ET

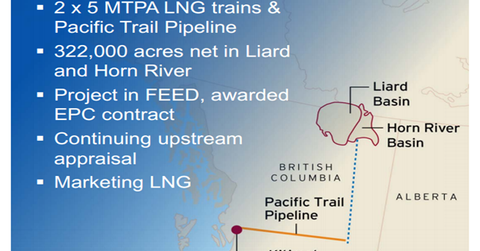

Kitimat liquefied natural gas project

Chevron (CVX) is cutting spending on the Kitimat liquefied natural gas project (or LNG) in Canada due to falling crude prices.

John Watson, CEO of Chevron, said, “People are pretty cautious right now in the LNG market. It’s not clear that all the Greenfield projects that are being contemplated can meet economic hurdles at some of the prices we are seeing.”

The company said that it is aligned with Woodside Petroleum on the project, which has replaced Apache Corp (APA), the company that had previously partnered with Chevron to develop the facility.

Poland

Chevron also announced that it will pull out of Poland and stop exploring for shale gas there. Chevron’s Polish unit decided to discontinue shale gas operations in Poland, as the opportunities there no longer seemed favorable for Chevron.

ExxonMobil (XOM), Total (TOT), and Marathon Oil (MRO) have also suspended shale gas exploration in Poland recently. As oil prices have been falling, several oil companies have decided to cut spending, especially in regions where their investments are failing.

Chevron makes up ~14% of the Energy Select Sector SPDR ETF (XLE) and has a weight of 1.2% in the SPDR S&P Oil & Gas Exploration & Production ETF (XOP). Therefore, for investors seeking more diversified exposure to the energy sector, XLE would be a better bet. CVX has a weight of 1% in the SPDR S&P 500 ETF (SPY). CVX is also a component of the iShares US Energy ETF (IYE).