Business overview: Phillips 66 Partners

Phillips 66 Partners (PSXP) is a master limited partnership formed by Phillips 66 (PSX). PSXP operations are integral to PSX refineries.

Jan. 19 2015, Published 4:06 p.m. ET

Phillips 66 Partners

Phillips 66 Partners (PSXP) is a master limited partnership formed by Phillips 66 (PSX). PSXP owns and operates crude oil and refined petroleum product pipelines, terminals, and storage systems in the central and Gulf Coast regions of the United States.

Organizational structure

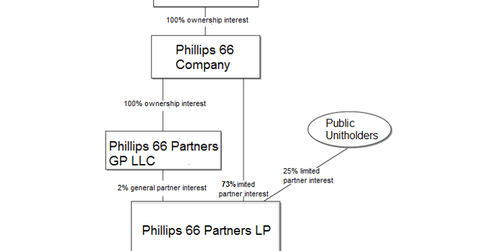

PSX owns a 100% interest in Phillips 66 Partners GP LLC, PSXP’s general partner. It also holds a 73% limited partner interest in PSXP.

Phillips 66 Partners GP LLC owns a 2% general partner interest in PSXP. The remaining 25% interest is held by public unitholders.

PSXP is a component of the Global X MLP & Energy Infrastructure ETF (MLPX) and the First Trust North American Energy Infrastructure Fund (EMLP). For its part, PSX is a component of the Energy Select Sector SPDR Fund (XLE) and the Vanguard Energy ETF (VDE).

PSXP: Crucial to PSX operations

PSXP operations are integral to PSX refineries such as the Lake Charles and Sweeny refineries as well as its Wood River refinery.

PSXP has multiple commercial agreements with PSX that represent a substantial source of the latter’s revenues. As a result of these agreements, as well as PSXP’s direct connections with PSX refineries, there is little room for competition from other pipelines, terminals, and storage facilities.

We’ll take a closer look at how PSXP’s interests are aligned with PSX’s later on in this series. Next, we’ll present a brief overview of PSXP’s assets.