Inventories Spike In November, Portending Weak December Sales

Sales fell 0.2% in November. Inventories increased 0.2%. Interestingly, the inventory build was with the retailers, not the manufacturers.

Dec. 4 2020, Updated 10:53 a.m. ET

Business inventories and sales data help predict economic activity

Business inventories are important economic drivers, especially when they build. Historically, recessions start with an inventory buildup. This causes businesses to slow production and lay off workers. In fact, most recessions have followed the same pattern up until the Great Recession.

Economic activity increases. This causes inflation. The Fed raises interest rates in response to the increased inflation. Business activity slows, the inventory increases, and workers get laid off. Once the inventory is worked down, the workers are rehired and another expansion begins.

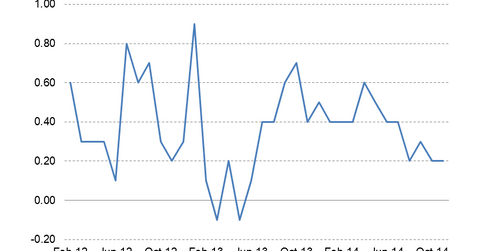

While the Great Recession was caused by excess debt, it’s still important to watch business inventories. It’s essential to focus on the inventory-to-sales ratio because spikes in this ratio forecast slowdowns. “Normalcy” is defined as a ratio of ~1.25–1.35. In early 2009, the ratio spiked to 1.48. Inventory buildups can cause temporary slowdowns in the context of an expanding economy. So, it’s important to watch them.

Sales fall, but inventory builds in November

Sales fell 0.2% in November. Inventories increased 0.2%. The inventory-to-sales ratio was flat at 1.31. A year ago, the inventory-to-sales ratio was 1.28. In a strong economy, the ratio usually ranges from 1.25 to 1.30. Interestingly, the inventory build was with the retailers, not the manufacturers. So this was another indication of our weak December retail sales. While this increase in the ratio doesn’t necessarily indicate that we’re headed toward a recession, it’s a cyclical data point that shouldn’t be ignored.

Implications for homebuilders

Until we see the inventory-to-sales ratios spike, homebuilders such as Lennar (LEN), D.R. Horton (DHI), PulteGroup (PHM), and Toll Brothers (TOL) will see nothing to suggest a recession is imminent. That said, investors in highly cyclical sectors like the homebuilding sector need to watch macroeconomic data closely.

An alternate way to invest in the sector would be through the SPDR S&P Homebuilders ETF (XHB).