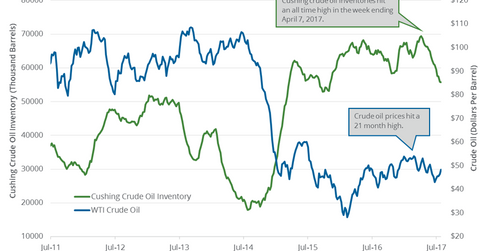

Cushing Inventories Rise for the First Time in 12 Weeks

Cushing is the largest crude oil storage hub in the United States. A market survey estimates that Cushing inventories fell from August 4 to August 11.

Nov. 20 2020, Updated 5:25 p.m. ET

Cushing inventories

Cushing is the largest crude oil storage hub in the United States. A market survey estimates that Cushing inventories fell from August 4 to August 11. Cushing crude oil inventories rose for the first time in 12 weeks for the week ending August 4, 2017. Cushing inventories are at their lowest level since November 2015. A fall in Cushing inventories has a positive impact on crude oil (IEZ)(XES)(PXI) prices.

Volatility in crude oil (USO)(UCO) prices impacts oil and gas producers such as Stone Energy (SGY), Hess (HES), Chevron (CVX), and Bill Barrett (BBG).

EIA’s report

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on August 9, 2017. The government agency reported that Cushing inventories rose by 0.56 MMbbls (million barrels) or 1% to 56.3 MMbbls between July 28 and August 4, 2017. Inventories have fallen by 8.86 MMbbls or 13.6% from the same period in 2016.

The EIA is scheduled to release its next weekly crude oil and gasoline inventory report on August 16, 2017, at 10:30 AM EST. For more on US crude oil inventories, read US Crude Oil Inventories Had a Massive Fall Last Week.

Impact

Cushing inventories are down ~19% from their all-time high in April 2017. Cushing inventories rose for the second time in the last 15 weeks. The expectation of a fall in nationwide and Cushing inventories would benefit crude oil (IEZ)(UCO) prices. Higher crude oil prices benefit oil producers such as Stone Energy (SGY) and Bill Barrett (BBG).

Next, we’ll analyze the US crude oil rig count and its impact on oil prices.