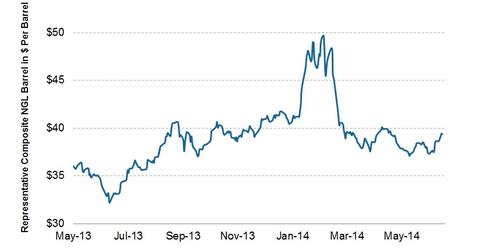

Natural gas liquids prices rise, boosted by propane prices

The representative NGL barrel reached highs of up to ~$50 per barrel in early February, given the strength in propane prices due to a cold winter as well as natural gas prices that pushed ethane prices up.

Nov. 20 2020, Updated 4:44 p.m. ET

Natural gas liquids are another component of upstream energy production

Natural gas liquids (or NGLs) are a group of hydrocarbons (ethane, propane, butanes, and pentanes) that are often found alongside dry natural gas (methane). Many upstream companies (companies that produce crude oil and natural gas) garner much of their revenue from producing and selling NGLs—especially those that have a significant amount of “rich gas” assets or natural gas assets “rich” in liquids. Some of these companies include Range Resources (RRC), Chesapeake Energy (CHK), SM Energy (SM), and Linn Energy (LINE). Price fluctuations in NGLs can affect the ultimate revenue and earnings of upstream companies, so NGL prices are an important indicator to track in the energy sector.

NGLs are made up of different compounds that receive different prices, and the production streams are largely ethane and propane

According to a presentation by the Midstream Energy Group, the average NGL barrel composition in December 2011 was ~43% ethane, ~28% propane, ~7% normal butane, ~9% isobutane, and ~13% pentanes or heavier hydrocarbons. Using this representative composite barrel, NGL prices closed higher at $39.42 per barrel on June 20, compared to $38.66 per barrel for the week ending June 13.

During the week, ethane prices were roughly flat at $0.29 per gallon, propane prices rose the most from $1.04 to $1.09 per gallon, butane prices rose from $1.23 per gallon to $1.29 per gallon, iso-butane prices rose from $1.33 per gallon to $1.38 per gallon, and natural gasoline prices dipped slightly from $2.30 to $2.28 per gallon. With NGL prices mostly up, the composite NGL barrel ultimately traded up 2% on the week.

The representative NGL barrel reached highs of up to ~$50 per barrel in early February, given the strength in propane prices due to a cold winter as well as natural gas prices that pushed ethane prices up. Since then, NGL prices have fallen so that the representative NGL barrel is around ~$40 per barrel—driven primarily by lower propane and ethane prices. Propane is used as a fuel for home heating, and prices had received a boost due to cold weather. In the past few years, ethane prices have correlated to natural gas prices, which also received support from the cold winter.

NGLs prices still remain up roughly 20% since lows in mid 2013. Through 3Q13 and 4Q13, NGL prices were helped by the rise in WTI crude prices, which shot up from ~$95 per barrel to $110 per barrel at points in the second half of 2013. Natural gas liquids prices correlate to movements in crude oil prices. Since then, crude prices have retreated somewhat. However, NGL prices have remained relatively robust. One factor in this trend is that the composite NGL barrel has been helped by an increase in propane prices, likely driven by higher propane exports.

Background: NGLs have historically tracked movements in crude prices

Historically, NGLs prices have largely tracked crude oil prices. However, over recent years, the composite barrel as a percentage of crude prices has declined. This is because ethane and propane make up a large percentage of the average NGL barrel, but these two commodities, especially, had experienced a surge in supply due to the shale boom and a decline in prices in relation to crude oil.

There’s still a correlation between NGL prices and crude, and movements in oil prices can cause NGL prices to move as well. The NGL barrel price relative to crude oil has recovered somewhat since June of 2013.

This week saw NGL prices trade up—a positive short-term indicator. Despite falling from the highs reached in February, NGL prices remained up significantly since late June 2013—a positive medium-term indicator. From a longer-term perspective, many producers still find current price levels economic enough to continue to target and drill for NGLs, but they’ve suffered from NGL prices coming off highs (~$50–$60 per barrel through much of 2011 versus ~$40 per barrel now). Major producers of NGLs include CHK, RRC, SM, and LINE—many of which are found in energy ETFs such as the Vanguard Energy ETF (VDE) and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

To learn more about important releases that affect oil and natural gas investments, see Market Realist’s Energy & Power page.