Why current secondhand oil tanker values suggest a mixed outlook

While the VLCC data is positive, the picture for the crude tanker business remains mixed. This could portray a short-to-medium-term negative outlook.

Dec. 4 2020, Updated 10:53 a.m. ET

Secondhand vessels

To get a more short-to-medium-term perspective of the crude tanker industry, analysts use secondhand vessel prices. These older ships trade in the secondary market, meaning they’re exchanged like stocks on NASDAQ or NYSE between ship owners, unlike shares that initially go public. Because buyers and sellers can employ these vessels right away after the transaction, unlike newbuild orders (which can take years), changes in secondhand values reflect the more immediate future fundamentals than what price changes in newbuilds show.

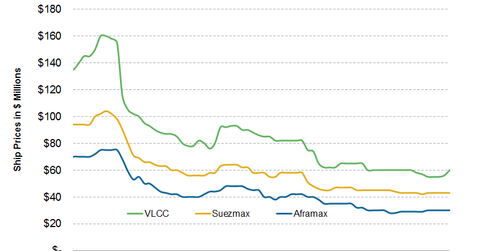

When secondhand vessel values appreciate, they generally depict a favorable outlook for the tanker business. But when they’re depreciating, expect storms. In our analysis, we’ll be using five-year-old vessel prices.

Trend

In October, values of five-year-old VLCCs rose to $60 million from $56 million a month ago. Suezmax and Aframax vessels, on the other hand, remained unchanged at $43 million and $30 million, respectively, according to leading international ship and offshore broker and investment bank R.S. Platou.

The increase in VLCC values is another indicator that reflects a very favorable supply and demand balance for the large ship class in the future. These large ships are typically used to haul large volumes of crude oil over long trips from the Middle East or West Africa to the rest of the world. Rising VLCC values tell us that rates are likely to rise because of higher demand for longer trips compared to expected increases in the ship supply based on current delivery schedules. Since the value of a ship depends on how much profit it can generate for its ship owner, just like the value of a stock often depends on how much the company can earn in profits over the next few months and years, higher VLCC values suggest higher rates ahead.

Mixed picture

While the VLCC data is positive, the picture for the crude tanker business remains mixed. As we saw earlier, prices for five-year-old Suezmax and Aframax vessels haven’t shown the kind of sharp increases shown in VLCCs. This could portray a short-to-medium-term negative outlook for Aframax. Of course, if demand for VLCCs rises enough, VLCC rates will rise, which will make employing Suezmax and Aframax vessels cheaper. As customers trade down, these smaller vessels will benefit as well—although we haven’t seen values for these vessels rise as much, so that may be more of a future story.

Impact on tanker stocks

This means that in the short to medium term, tanker stocks like Teekay Tankers Ltd. (TNK), Tsakos Energy Navigation Ltd. (TNP), Frontline Ltd. (FRO), and Nordic American Tanker Ltd. (NAT) would likely face headwinds. Companies with poor balance sheets are still at risk of defaulting. Investors trying to take advantage of the improving long-term outlook for the crude tanker industry but wishing to minimize risk can use the Guggenheim Shipping ETF (SEA), which invests in large shipping companies with strong financials.