Hilton Worldwide Holdings Looks Promising despite a Tough 2017

Hilton Worldwide Holdings’ (HLT) revenue grew 3% in 2016. Management and franchise fees, timeshare, and other revenues from managed and franchised properties drove the growth in 2016, offset by owned and leased hotels.

Jan. 11 2018, Updated 7:35 a.m. ET

What drove revenue growth for Hilton Worldwide Holdings?

Hilton Worldwide Holdings’ (HLT) revenue grew 3% in 2016. Management and franchise fees, timeshare, and other revenues from managed and franchised properties drove the growth in 2016, offset by owned and leased hotels. The United States drove the growth, offset by the other operating areas.

Revenue grew 24% in 9M17. Franchise fees, base and other management fees, incentive management fees, other revenues, and other revenues from managed and franchised properties drove the growth offset by owned and leased hotels.

What led to the fall in EPS?

Gross profit grew 6% in 2016 and 30% in 9M17. Operating expenses increased 12% and 27% in 2016 and 9M17, respectively. Expenses from managed and franchised properties drove the expenses. As a result, operating income fell 10% in 2016 before gaining 45% in 9M17. Adjusted operating income grew 9% in 2016 before falling 37% in 9M17.

Interest expense increased during the periods. Loss on foreign currency transactions was recorded in 2015 and 2016—unlike 2017. A loss of debt extinguishment was recorded in 9M17. Adjusted net income grew 10% in 2016 before falling 27% in 9M17. Adjusted diluted EPS (earnings per share) grew 10% in 2016 before falling 25% in 9M17. Share buybacks enhanced the 9M17 EPS.

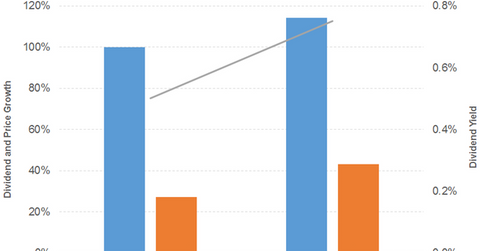

Dividend and price growth

Dividend per share grew 100% and 114% in 2016 and 2017, respectively. Prices gained 27% and 43% in 2016 and 2017, respectively. As a result, the upward-rising dividend yield curve has a flat slope. A forward PE of 41.9x and dividend yield of 0.8% compares to a sector average forward PE of 30.3x and a dividend yield of 1.1%.

How does it compare to the broad indexes?

The S&P 500 (SPX-INDEX)(SPY) offers a dividend yield of 2.2%, a PE ratio of 23.4x, and a YTD return of 19.6%. The Dow Jones Industrial Average (DJIA-INDEX)(DIA) has a dividend yield of 2.2%, a PE ratio of 22.3x, and a YTD return of 25.1%. The NASDAQ Composite (COMP-INDEX)(ONEQ) has a PE ratio of 28.2x and a YTD return of 24.8%.

What is the revenue and EPS outlook?

Hilton Worldwide Holdings is projected to record negative revenue growth of 22% in 2017, followed by 7% growth in 2018. The diluted EPS is projected to fall 29% in 2017 before gaining 22% in 2018.