WisdomTree U.S. LargeCap Dividend Fund

Latest WisdomTree U.S. LargeCap Dividend Fund News and Updates

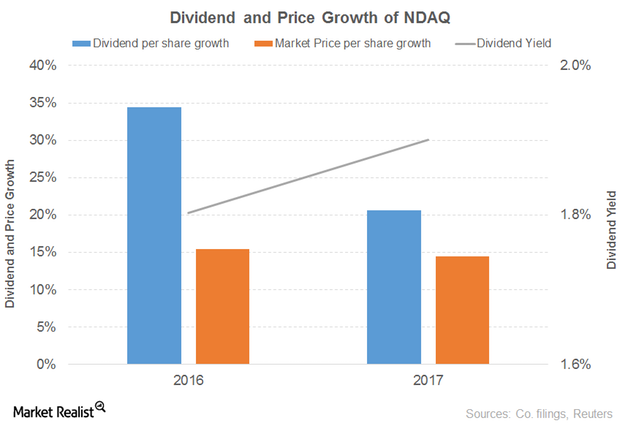

What’s behind the Outlook for Nasdaq?

Nasdaq (NDAQ) revenue rose 9% and 8% in 2016 and 9M17, respectively.

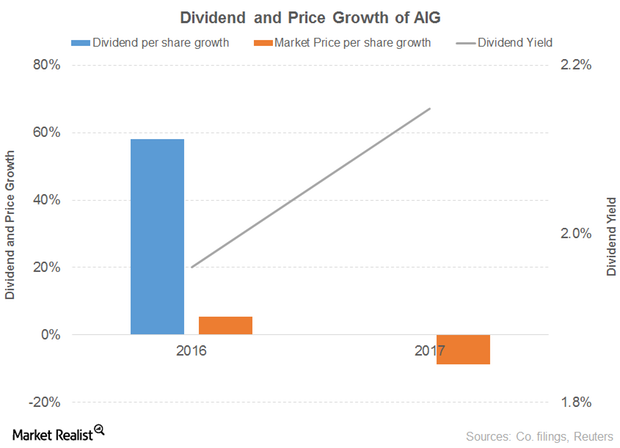

What’s the Outlook for American International Group?

American International Group’s dividend per share rose 58% in 2016 and was flat in 2017.

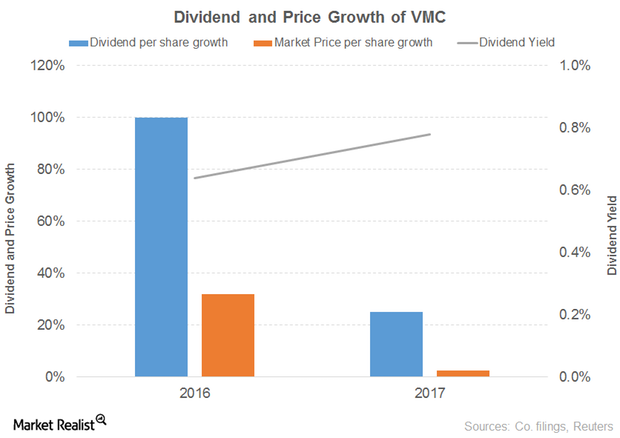

The Outlook for the Vulcan Materials Company

The Vulcan Materials Company’s (VMC) revenue grew 5% and 7% in 2016 and 9M17, respectively. Aggregates, concrete, and calcium drove the growth in 2016, offset by asphalt mix.

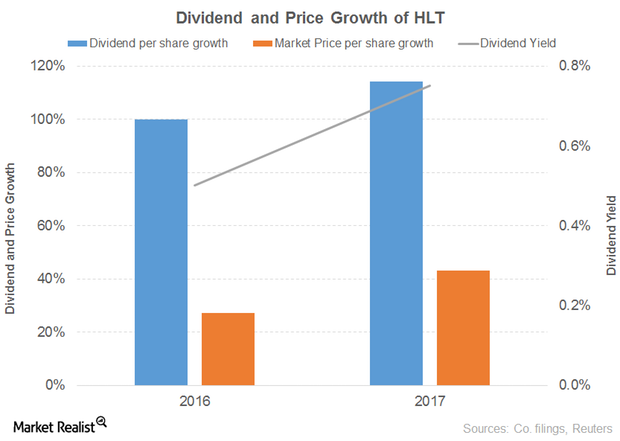

Hilton Worldwide Holdings Looks Promising despite a Tough 2017

Hilton Worldwide Holdings’ (HLT) revenue grew 3% in 2016. Management and franchise fees, timeshare, and other revenues from managed and franchised properties drove the growth in 2016, offset by owned and leased hotels.

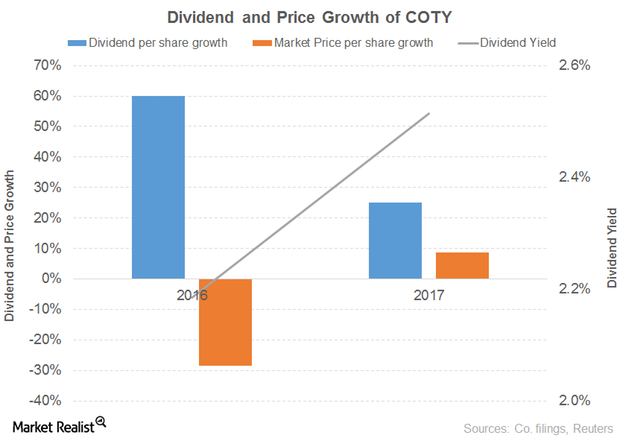

How Coty’s Performance Affected Its Outlook

Coty (COTY) net revenue fell 1% in 2016 before climbing 76% in 2017. The Consumer Beauty segment drove the growth in both years.

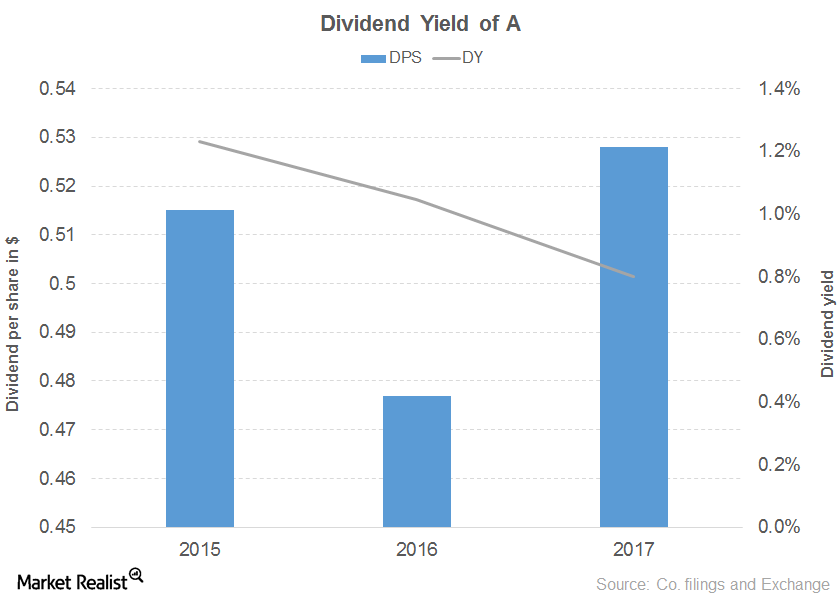

Agilent Technologies’ Downward Sloping Dividend Yield Curve

Agilent Technologies’ net revenue rose 6.0% in the first nine months of 2017, driven by every segment. Income from operations rose 41.0% as total costs didn’t increase much.

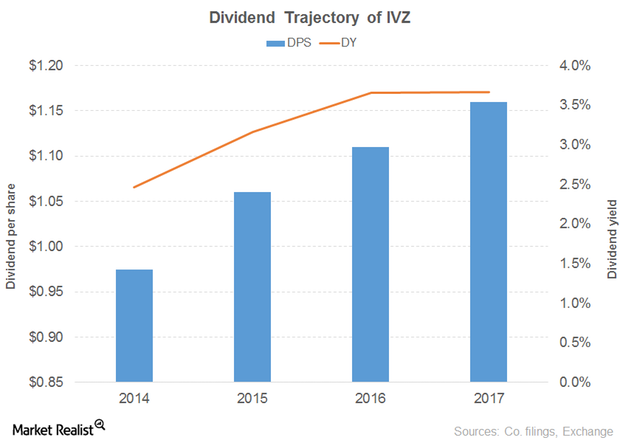

How Invesco’s Dividend Yield Curve Has Evolved

Revenue and earnings Investment management company Invesco (IVZ) saw its revenue fall 8% in 2016, after flat growth in 2015. In 2016, its investment management, service and distribution, and performance fees fell. Its operating expenses fell 3%–5% in 2015 and 2016, and its operating income fell 13% in 2016 after rising 6% in 2015. Meanwhile, its […]

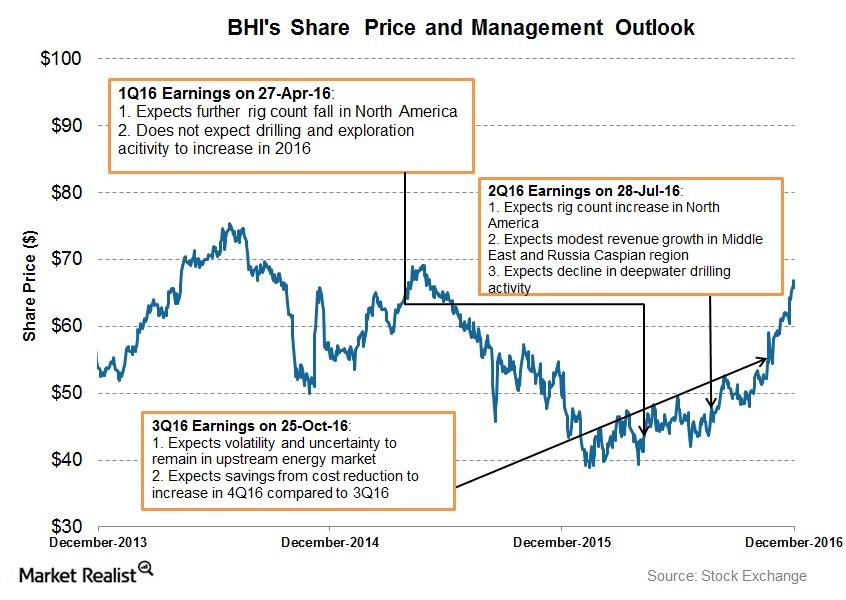

How Does Baker Hughes’s Management View 4Q16?

In 4Q16, Baker Hughes’s (BHI) management expects a trade-off between strong North American upstream activity and a weaker international energy environment.