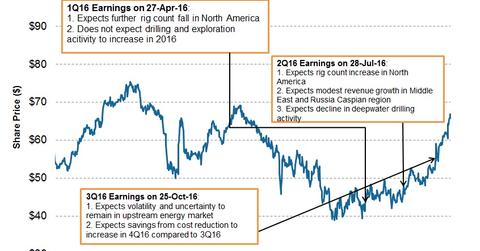

How Does Baker Hughes’s Management View 4Q16?

In 4Q16, Baker Hughes’s (BHI) management expects a trade-off between strong North American upstream activity and a weaker international energy environment.

Dec. 14 2016, Updated 8:06 a.m. ET

Baker Hughes expects pockets of improvement in 4Q16

In 4Q16, Baker Hughes’s (BHI) management expects a trade-off between strong North American upstream activity and a weaker international energy environment.

In the company’s 3Q16 earnings press release, Martin Craighead, BHI’s chairman and CEO, commented, “Looking ahead, in the fourth quarter of 2016 we expect activity in North America to modestly increase, as our customer community slowly begins to ramp up activity in what remains a tough pricing environment. Internationally, we are forecasting activity declines and pricing pressure to continue, with minimal year-end, seasonal product sales unlikely to offset those declines.”

How Baker Hughes’s management views its geographies

- Baker Hughes expects modest North American energy production growth and challenging prices for OFS products and services.

- BHI expects lower activity and pricing pressure to continue in BHI’s international operations.

- Baker Hughes anticipates growth opportunities in Kuwait, the United Arab Emirates, India, and Oman.

- BHI expects lower revenue in Africa due to ongoing reductions in deepwater activity.

- Baker Hughes expects the Latin American market to remain flat.

How much can Baker Hughes save?

During the company’s 3Q16 conference call, Craighead noted, “Starting with costs, last month we said that we expected to achieve the $500 million in savings by the end of the third quarter, three months ahead of our original timeline, and that we had identified additional savings opportunities beyond that.

“To that end, I’m pleased to say that we not only have achieved that goal, but we now expect the total annualized savings run rate to increase by 30% to $650 million by year end.”

BHI comprises 0.06% of the WisdomTree LargeCap Dividend ETF (DLN). The energy sector accounts for 11.9% of DLN.