WisdomTree U.S. Total Dividend Fund

Latest WisdomTree U.S. Total Dividend Fund News and Updates

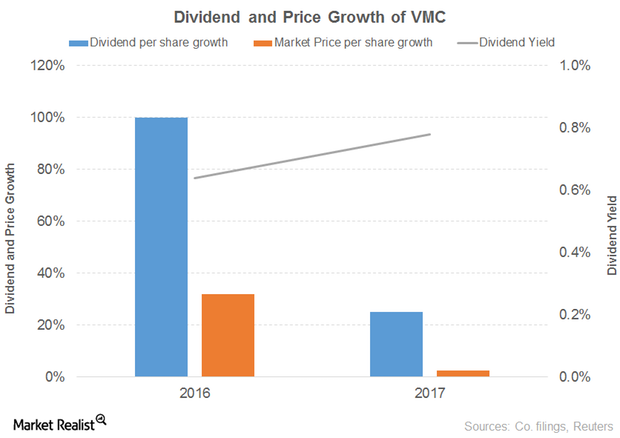

The Outlook for the Vulcan Materials Company

The Vulcan Materials Company’s (VMC) revenue grew 5% and 7% in 2016 and 9M17, respectively. Aggregates, concrete, and calcium drove the growth in 2016, offset by asphalt mix.

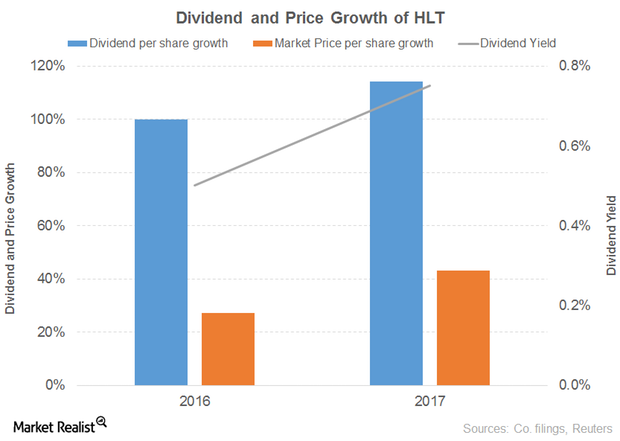

Hilton Worldwide Holdings Looks Promising despite a Tough 2017

Hilton Worldwide Holdings’ (HLT) revenue grew 3% in 2016. Management and franchise fees, timeshare, and other revenues from managed and franchised properties drove the growth in 2016, offset by owned and leased hotels.

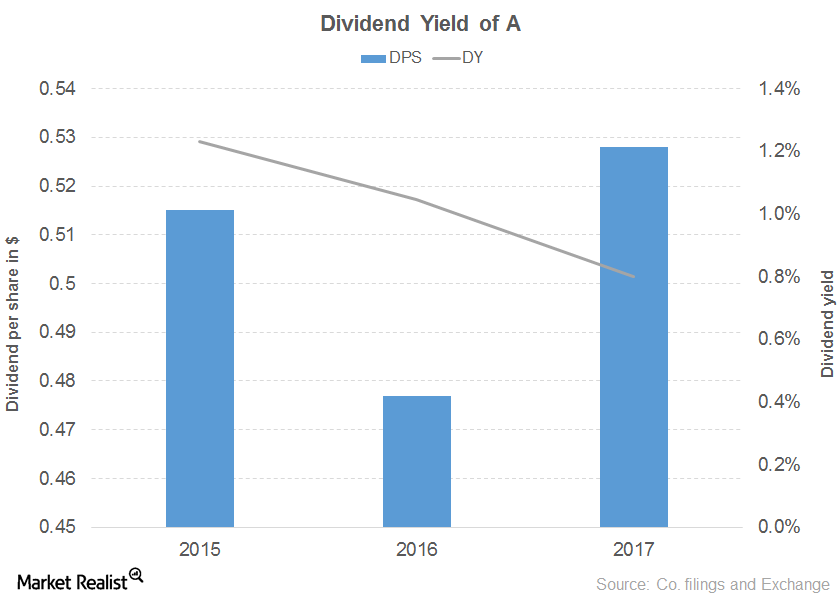

Agilent Technologies’ Downward Sloping Dividend Yield Curve

Agilent Technologies’ net revenue rose 6.0% in the first nine months of 2017, driven by every segment. Income from operations rose 41.0% as total costs didn’t increase much.

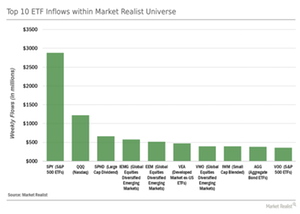

Category Flows: Looking for Yield? Be Picky!

The rise of the actively selective investor becomes more nuanced within the context of our entire ETF universe.

Wall Street’s Forecasts for Halliburton after 2Q16 Earnings

Approximately 82% of analysts tracking Halliburton rate it a “buy” or some equivalent. About 16% rate it a “hold” or equivalent, and 2% recommend a “sell.”