Which Natural Gas–Weighted Stocks Could Follow Oil?

WPX Energy had the lowest correlation with natural gas prices in the past five trading sessions. Southwestern Energy had among the highest correlations.

Nov. 20 2020, Updated 4:12 p.m. ET

Correlations of natural gas–weighted stocks

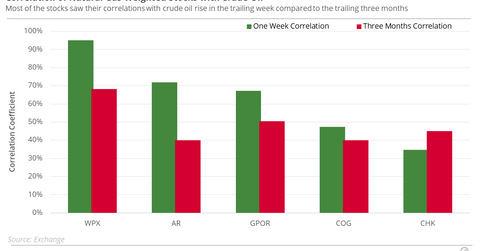

The natural gas–weighted stocks that could be volatile with oil’s movement, according to the correlations with US crude oil (USO) (USL) futures on December 6–13, 2017, are:

WPX Energy had the lowest correlation with natural gas prices in the past five trading sessions, as we discussed in the previous part. In the next part, our focus will be on the returns of these natural gas–weighted stocks.

All of these natural gas–weighted stocks with at least 60.0% production mixes in natural gas have been taken from the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

The natural gas–weighted stocks that might deviate from oil’s movement, according to the correlations with natural gas prices in the last five trading sessions, are:

Southwestern Energy had among the highest correlations with natural gas, as we discussed in the previous part.

Oil’s role

The natural gas–weighted stocks’ interaction with oil prices could be because of oil’s role in natural gas supplies. In general, the energy sector can be influenced by oil.