Crude Oil Prices: Which Factor Could Change the Trend?

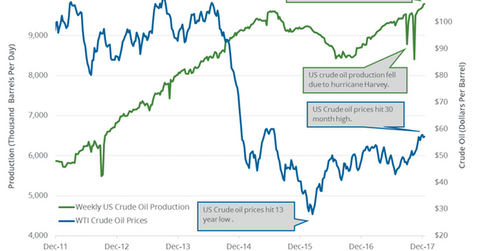

The EIA estimated that US crude oil production rose by 9,000 bpd (barrels per day) to 9,789,000 bpd on December 8–15, 2017.

Dec. 21 2017, Published 9:12 a.m. ET

Weekly US crude oil production

The EIA estimated that US crude oil production rose by 9,000 bpd (barrels per day) to 9,789,000 bpd on December 8–15, 2017. Production is at the highest level ever. US crude oil production rose by 1,003,000 bpd or 11.4% year-over-year. Production increased for the ninth straight week. WTI oil (DWT) (UCO) prices have fallen 1.5% since the highs on November 24, 2017, due to record US production.

Oil prices influence the Vanguard Energy ETF (VDE). It rose 1.5% to 96.19 on December 20, 2017.

US crude oil production recovery

US crude oil production hit 8,428,000 bpd (barrels per day) on July 1, 2016—the lowest production in more than two years. Production rose by 1,361,000 bpd or 16.1% from the lows on July 1, 2016. Relatively higher oil prices in 2017 compared to 2016 and improving drilling costs led to the rise in US production.

Estimates for 2018

US production could average ~10,020,000 bpd in 2018, according to the EIA. It will be the highest annual production average ever. Higher oil prices in 4Q17 will contribute to higher crude oil rigs and production. It also benefits oil producers (FXN) (IYE) like Hess (HES), Newfield Exploration (NFX), and Goodrich Petroleum (GDP).

Production cuts and US oil production

Major oil producers extended the production cuts until December 2018. US oil production has risen by 843,000 bpd or 9.4% from January 2017 to December 15, 2017. It has offset ~47% of the production cuts.

Impact

The International Energy Agency expects that US crude oil production will increase by 870,000 bpd in 2018. The rise in crude oil supplies from non-OPEC producers could partially offset the production cuts in 2018. The rise in non-OPEC supplies will be the biggest trend changer for oil prices in 2H18. It would pressure crude oil prices in 2018.

Next, we’ll discuss another bearish driver for crude oil in 2018.