Can US Crude Oil Break Below $57 Next Week?

On December 14, 2017, the implied volatility of US crude oil futures was 18.1%. It was 14.8% below its 15-day average.

Dec. 18 2017, Updated 7:33 a.m. ET

Implied volatility

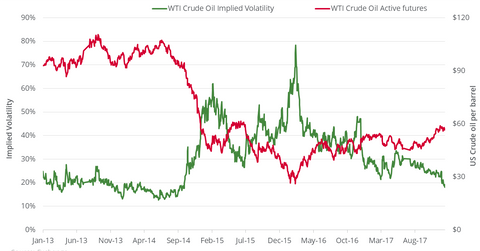

On December 14, 2017, the implied volatility of US crude oil futures was 18.1%. It was 14.8% below its 15-day average. That day, implied volatility was the least since September 30, 2014.

On February 11, 2016, bearish sentiments pushed US crude oil (USL) (DBO) (OIIL) futures to their 12-year low, while implied volatility hit 75.2%. Since the multiyear low, the rise in oil prices was more than 100%. Implied volatility fell 75.9% over this period. The above chart demonstrates this converse relationship.

Oil prices

There’s a 68% chance that between December 15 and December 21, 2017, the closing price of US crude oil futures will fall between $55.61 and $58.47 per barrel. This model assumes that prices are normally distributed. The implied volatility for this calculation was 18.1%.

On December 14, 2017, US crude oil January 2018 futures closed at $57.04 per barrel. If oil prices break below the $57 level next week, the S&P 500 Index (SPY) and the Dow Jones Industrial Average Index (DIA) could be influenced by the downturn. These equity indexes’ energy sector allocations that we looked at in Part 2 could be sensitive to oil prices. Energy ETFs that we looked at in Part 3 and others such as the Fidelity MSCI Energy ETF (FENY) stand to lose with a fall in oil.