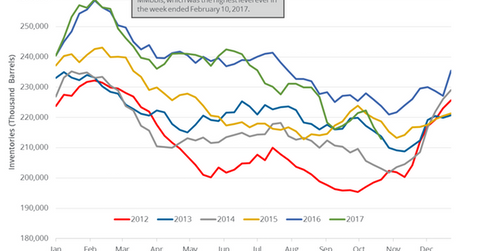

US Gasoline Inventories Fell 18%, Bullish for Crude Oil

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell by 4,020,000 barrels to 212.8 MMbbls on October 20–27, 2017.

Nov. 3 2017, Published 11:08 a.m. ET

US gasoline inventories

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell by 4,020,000 barrels to 212.8 MMbbls (million barrels) on October 20–27, 2017. The inventories are at the lowest level since August 14, 2015. The inventories have fallen 1.8% week-over-week and by 10.95 MMbbls or 4.8% YoY (year-over-year).

The market expected that US gasoline inventories would have fallen by 1,506,000 barrels on October 20–27, 2017. A massive draw in gasoline inventories supported US gasoline (UGA) and crude oil (DTO) (UCO) (UWT) futures. US gasoline futures rose 1.7% to $1.76 per gallon on November 2, 2017. US refiners (CRAK) like Holly Frontier (HFC) and Marathon Petroleum (MPC) benefit from higher gasoline prices.

US gasoline production and demand

US gasoline production rose by 251,000 bpd (barrels per day) to 10,187,000 bpd on October 20–27, 2017. Production had risen 2.5% week-over-week and by 363,000 bpd or 3.6% YoY.

US gasoline demand rose by 147,000 bpd to 9,461,000 bpd on October 20–27, 2017. The demand rose 1.6% week-over-week and by 278,000 bpd or 3.1% YoY.

High gasoline demand also supported gasoline and crude (USO) (DWT) prices on November 2, 2017. US crude oil futures are at a 28-month high. Energy producers (RYE) (PXI) like EOG Resources (EOG), Whiting Petroleum (WLL), and Marathon Oil (MRO) benefit from higher oil prices.