Phillips 66: An overview

In 2013, Phillips 66 generated 67%, 13%, and 6% of its revenues from the United States, the United Kingdom, and Germany, respectively. The company’s other foreign operations contributed ~16%.

Nov. 20 2020, Updated 1:32 p.m. ET

Phillips 66 focuses on refining, chemicals, midstream, and marketing and specialties

Phillips 66 (PSX) released its 3Q14 earnings on October 29, 2014. In this series, we’ll discuss the company’s earnings and analyze its performance. But first, let’s look at Phillips 66’s operations.

Phillips 66 (PSX) is a Texas-based energy company. The company primarily focuses on refining, chemicals, midstream operations, and the marketing of refined and specialties products. Phillips 66 engages in the manufacturing of gasoline, distillates, jet fuel, asphalt, lubricants, petrochemicals, and other refined products.

Phillips 66 (PSX) started operating independently as a publicly traded company on April 4, 2012, when it separated from ConocoPhillips (COP).

Phillips 66’s segments

Phillips 66 (PSX) has four primary operating segments:

- Midstream

- Chemicals

- Refining

- Marketing and Specialties

In 2013, Phillips 66 (PSX) formed Phillips 66 Partners (PSXP), a master limited partnership (or MLP) to operate its midstream functions such as crude oil and petroleum products transportation through pipelines and terminals. Phillips 66 owns the general partnership and 73% limited partnership of Phillips 66 Partners (PSXP).

To know more about MLPs, check out our articles in Master limited partnership (MLP) basics.

Phillips 66’s (PSX) midstream segment includes 50% equity investment in DCP Midstream, LLC, a subsidiary of DCP Midstream Partners (DPM).

Phillips 66’s chemical segment consists of 50% equity investment in Chevron Phillips Chemical Company LLC (or CPChem), which is a joint venture between Chevron Corporation (CVX) and Phillips Petroleum Company.

Valero Energy Corporation (VLO) is another major petrochemical refining and marketing company in the United States. Phillips 66 (PSX) and Valero Energy (VLO) are components of Energy Sector Select Standard and Poor’s depositary receipt (or SPDR) exchange-traded fund (or ETF) (XLE).

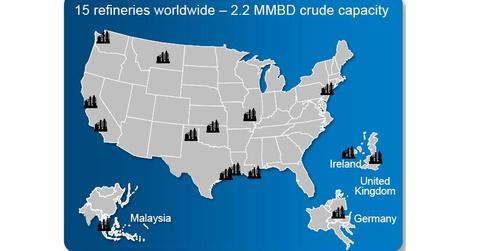

Phillips 66’s international operations

Phillips 66 (PSX) has operations in the United States, the United Kingdom, Germany, and other countries. In 2013, Phillips 66 generated 67%, 13%, and 6% of its revenues from the United States, the United Kingdom, and Germany, respectively. The company’s other foreign operations contributed ~16%.

One-year share up

Phillips 66 (PSX) currently trades at ~$77. This is up ~19% in the past one year.

Following the quarterly results released on October 29, 2014, its share dropped 1.5% from the previous day’s close.

Read the following section to know how Phillips 66’s earnings fared against analysts’ estimates, and find out the brokers’ recommendations for Phillips 66 (PSX).

The company’s current market capitalization at ~$41.2 billion is one of the largest in the U.S. downstream industry. Its enterprise value is ~$45.5 billion.