Futures Spread: A Look at Natural Gas Supply–Demand Concerns

On October 4, 2017, natural gas (UNG) (GASL) November 2018 futures traded $0.08 above the November 2017 futures.

Oct. 5 2017, Updated 2:36 p.m. ET

Futures spread

On October 4, 2017, natural gas (GASL) November 2018 futures traded $0.08 above the November 2017 futures. The difference between these two futures contracts is known as the futures spread.

On September 27, 2017, November 2018 futures settled just one-tenth of a cent above the November 2017 futures. As a result, the futures spread was at a premium of $0.001. Between September 27 and October 4, 2017, natural gas futures fell 4%.

At a premium

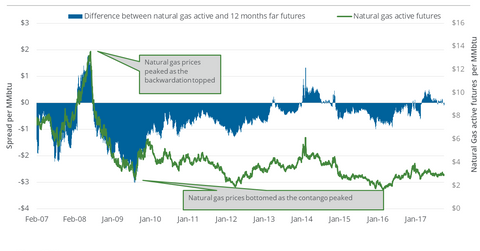

When the premium expands, it usually coincides with the fall in natural gas prices. If the premium falls, natural gas prices could rise. For example, the premium rose to $0.84 on March 3, 2016. Natural gas futures settled at their 17-year low on the same date.

At a discount

When the discount expands, it usually coincides with the rise in natural gas prices. If the discount falls, natural gas prices could fall. For example, the discount rose to ~$0.50 on May 12, 2017. Natural gas futures settled at their 2017 high on the same date.

In the trailing week, natural gas futures plunged, resulting in the expansion of the spread premium. This movement could be an indication of concerns regarding a fall in demand amid bearish weather forecasts.

Energy stocks

The shape of the forward curve is important for natural gas producers’ (XOP)(DRIP)(IEO) hedging-related decisions. This curve is also important for midstream companies’ (AMLP) natural gas storage, processing, and transportation businesses.

The difference between natural gas’s active futures and the following month’s futures could be the main driver for returns of funds such as the United States Natural Gas ETF (UNG).

On October 4, 2017, natural gas futures contracts to January 2018 settled at progressively higher prices.