Pre-Hurricane Harvey, US Crude Oil Demand Hit a Record High

US refinery crude oil demand The EIA (U.S. Energy Information Administration) estimates that US refinery crude oil demand rose by 264,000 bpd (barrels per day) to 17,725,000 bpd between August 18 and 25, 2017, reaching the highest level since 1982. Refinery demand rose 1.5% week-over-week and rose 1,110,000 bpd, or 6.6%, year-over-year. High refinery demand is […]

Sept. 10 2017, Updated 1:11 p.m. ET

US refinery crude oil demand

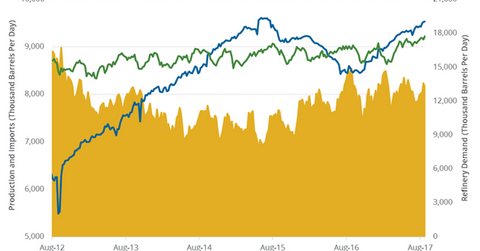

The EIA (U.S. Energy Information Administration) estimates that US refinery crude oil demand rose by 264,000 bpd (barrels per day) to 17,725,000 bpd between August 18 and 25, 2017, reaching the highest level since 1982. Refinery demand rose 1.5% week-over-week and rose 1,110,000 bpd, or 6.6%, year-over-year. High refinery demand is bullish for crude oil (UWT) (DWT) prices, and high crude oil prices benefit crude oil producers such as Matador Resources (MTDR), Comstock Resources (CRK), Northern Oil & Gas (NOG), and Goodrich Petroleum (GDP).

US crude oil imports

US crude oil imports fell by 885,000 bpd to 7,905,000 bpd between August 18 and 25, 2017. Imports fell 10% week-over-week and 1,012,000 bpd (11.3%) year-over-year.

US crude oil imports are expected to fall due to Hurricane Harvey, which hit the mainland on August 26, 2017. It led to heavy rain and flooding in Texas. All ports in Texas have been shut down.

Hurricane Harvey and refinery demand

Reuters estimates that around 4.4 MMbpd of US refining capacity is offline due to Hurricane Harvey, representing almost 25% of US refining production. Experts believe that it will take more than a week to restart refinery activity. Whereas lower refinery demand is bearish for crude oil prices, it has supported gasoline prices. US gasoline (UGA) prices are at a two-year high. Higher gasoline prices have a positive effect on refiners such as Valero (VLO), Western Refining (WNR), and Marathon Petroleum (MPC). In the next part, we’ll look at how US crude oil production influences crude oil prices.