Johnson & Johnson’s Revenue Estimates for 4Q17

Johnson & Johnson’s (JNJ) Pharmaceutical segment contributes more than 45% to total revenues. In 4Q17, it’s expected to report growth in operating revenues.

Jan. 19 2018, Updated 9:35 a.m. ET

Johnson & Johnson’s revenue estimates

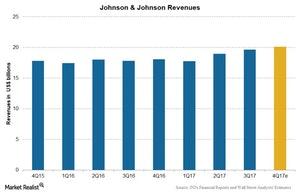

As we saw in Part 1 of this series, Johnson & Johnson (JNJ) is expected to report a 10.9% growth in revenue to $20.1 billion in 4Q17 compared to 4Q16. Reported revenues are expected to increase 6.2% to $76.3 billion for 2017 compared to 2016.

The above chart compares the actual revenues for Johnson & Johnson since 1Q16 and estimates for 4Q17. We’ll look at the factors impacting these revenues later in the series.

Business segments in 4Q17

Johnson & Johnson operates through the following three segments:

- Pharmaceutical

- Consumer

- Medical Devices

The Pharmaceutical segment contributes more than 45% of JNJ’s total revenues. In 4Q17, the segment is expected to report growth in operating revenues, with a favorable impact from foreign exchange. Growth is expected to be driven by Invega Sustenna and Invega Trinza from the neuroscience franchise, Tremfya and Stelara from the immunology franchise, Imbruvica and Darzalex from the oncology franchise, and Xarelto from the cardiovascular and metabolics franchise. Growth is expected to be partially offset by lower sales of Hepatitis C products.

In 4Q17, the Consumer segment is expected to report growth in operating revenues with a positive impact from foreign exchange. Growth is expected to be driven by increased sales of beauty care products, women’s health products, over-the-counter products, and wound care products. However, lower sales of baby care products and oral care products will partially offset growth for the quarter.

The Medical Devices segment is expected to report growth in operating revenues in 4Q17, with a positive impact from foreign exchange. Growth is expected to be driven by strong sales for the cardiovascular franchise, general and advanced surgery products, knees and trauma products, and contact lenses from the vision care franchise. However, lower sales of diabetes products will partially offset growth in the quarter.

We’ll take a look at JNJ’s key products in later parts of this series.

The SPDR S&P Pharmaceuticals ETF (XPH) holds 4.4% of its total investments in Johnson & Johnson (JNJ), 4.7% in Merck & Co. (MRK), 5% in Mylan (MYL), and 4.4% in Allergan (AGN).