Could Crude Oil Futures Rise Due to Short Covering?

In this series, we’ll review US crude oil inventories, refinery demand, production, and gasoline and distillate inventories.

Sept. 10 2017, Updated 1:03 p.m. ET

US crude oil futures

October WTI (West Texas Intermediate) crude oil (RYE) (OIH) (DBO) futures contracts rose 2.8% to $47.23 per barrel on August 31, 2017. US crude oil futures rose for the first time in four days. Moves in crude oil prices impact oil producers such as QEP Resources (QEP), Hess (HES), and PDC Energy (PDCE).

Gasoline futures

September gasoline futures rose 13.5% to $2.13 per gallon on August 31, 2017, the largest single-day increase since March 2016. Gasoline prices rose due to hurricane Harvey.

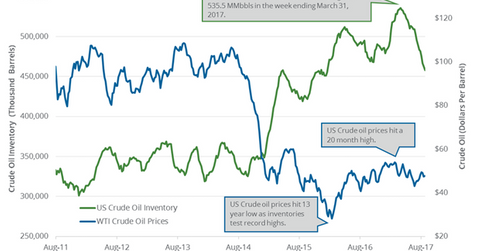

US crude oil futures this year

US crude oil futures are approaching a five-week low, and have fallen 17.4% YTD (year-to-date). They are also under pressure due to US crude oil production rising last week. Production is at a 25-month high.

However, crude oil prices could rise due to the short covering. The supply outage in Libya could also support crude oil prices. Libya’s National Oil Corporation (or NOC) states that three major oil fields in the country have been shut down due to militant attacks. The Central Bank of Libya has stated that the supply outage may have prompted the fall in Libyan crude oil production by 350,000 barrels per day in August 2017. Libya was producing 1 million barrels per day before the militant attacks.

EIA crude oil inventories

On August 30, 2017, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report. US crude oil prices fell despite the fall in crude oil inventories. Inventories are at the lowest level since January 2016. In this series, we’ll review US crude oil inventories, refinery demand, production, and gasoline and distillate inventories.