Will ECB’s Tightening Lead to Bond Market Sell-Off?

If the European economy continues to improve at the current pace, the QE program could be scaled down to 40.0 billion euros per month.

Aug. 23 2017, Published 10:16 a.m. ET

ECB’s QE to be in focus

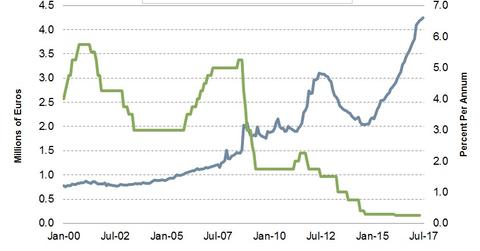

Recent economic data from the Eurozone show strong economic growth. Unemployment has been falling, and inflation (TIP) has been increasing in recent months. Political uncertainty that threatened the existence of the European Union a few months ago no longer exists. These developments give sufficient ammunition for the ECB (European Central Bank) to scale down its QE (quantitative easing) program. The ECB currently purchases 60.0 billion euros per month and has previously announced that the purchases would continue at the current pace at least until January 2018. The markets (BWX) are now expecting the ECB to announce tapering at the October meeting.

Changes expected to QE

If the European economy continues to improve at the current pace, the QE program could be scaled down to 40.0 billion euros per month and could be completely finished by the end of 2018. The risk to this plan could be the appreciation of the euro (FXE). The shared currency has appreciated against the US dollar (UUP) as the ECB’s talks of tightening emerged. This appreciation is likely to have a negative impact on European inflation as import costs go down and European exports become expensive.

How will tightening impact the bond markets?

The first impact of tightening would be on European bond yields (GGOV). Peripheral European countries’ bond yields are likely to rise more than core nations such as Germany and France, leading to widening yield spreads. The yield curve in the European Union is likely to become steeper in response to rising global and US yields. A tighter monetary policy from the ECB wouldn’t have a great impact on the bond markets, but widening yields could mean trouble for peripheral EU nations and their banking systems.