ProShares German Sovereign/Sub-Sovereign

Latest ProShares German Sovereign/Sub-Sovereign News and Updates

Analyzing the European Central Bank’s October Statement

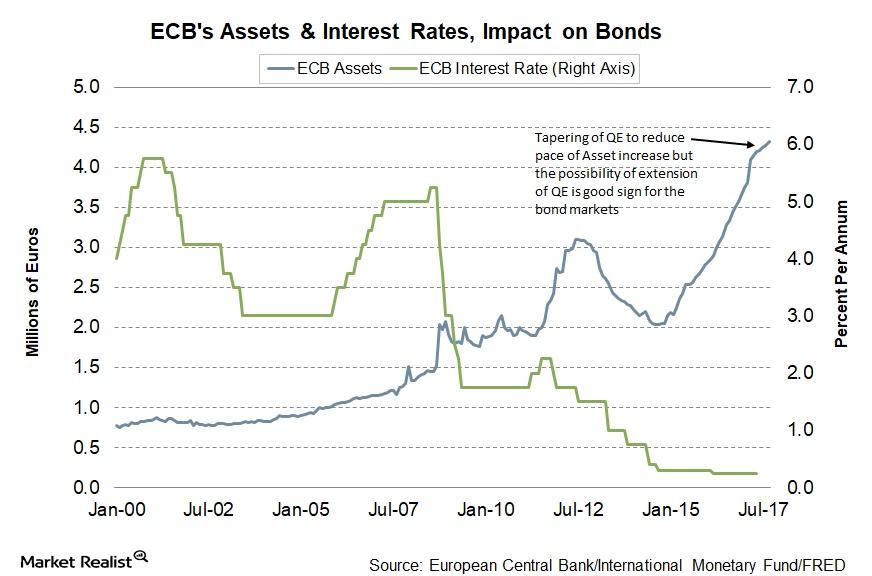

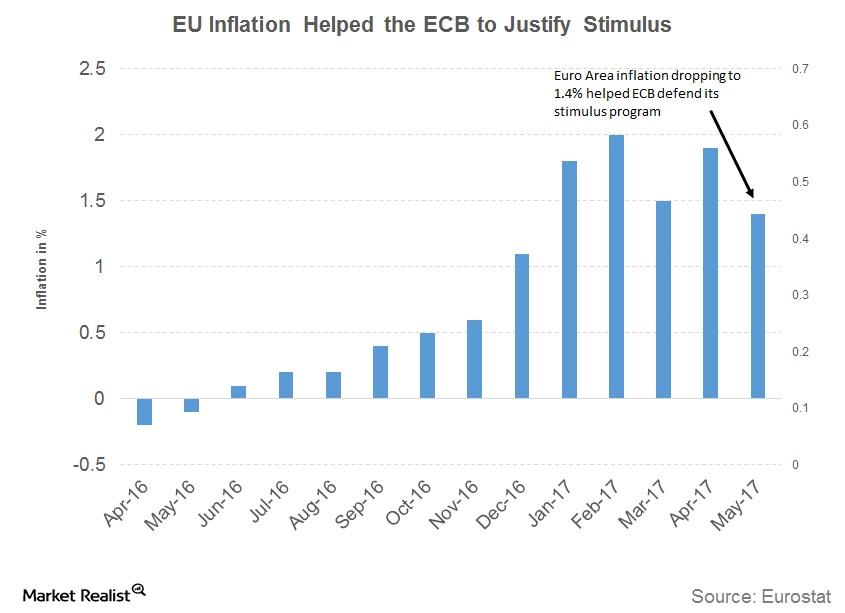

The reduction to the ECB’s bond-buying program will likely have a mixed impact on the bond markets of countries in the European Union.

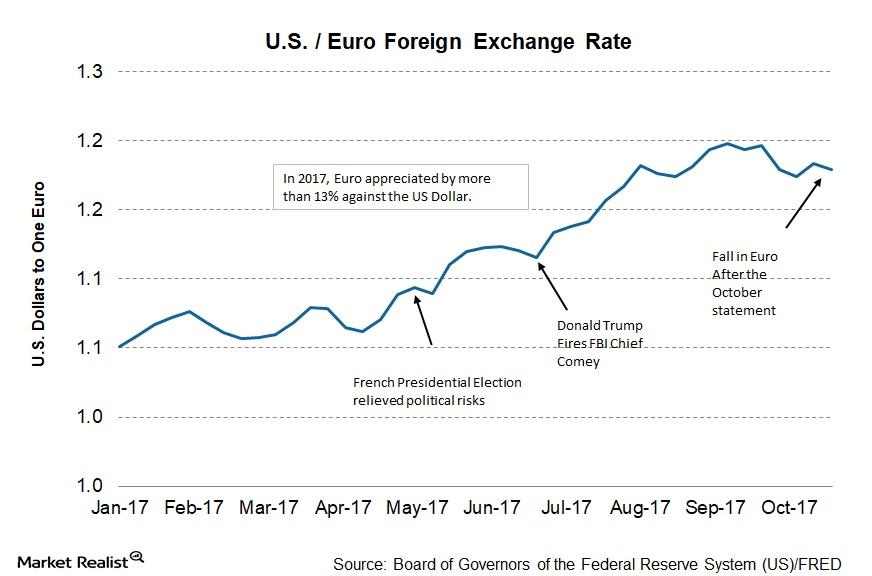

Why the ECB Isn’t Worried about the Appreciating Euro

In the ECB’s (European Central Bank) October policy meeting, the ECB didn’t explicitly talk about the appreciating euro.

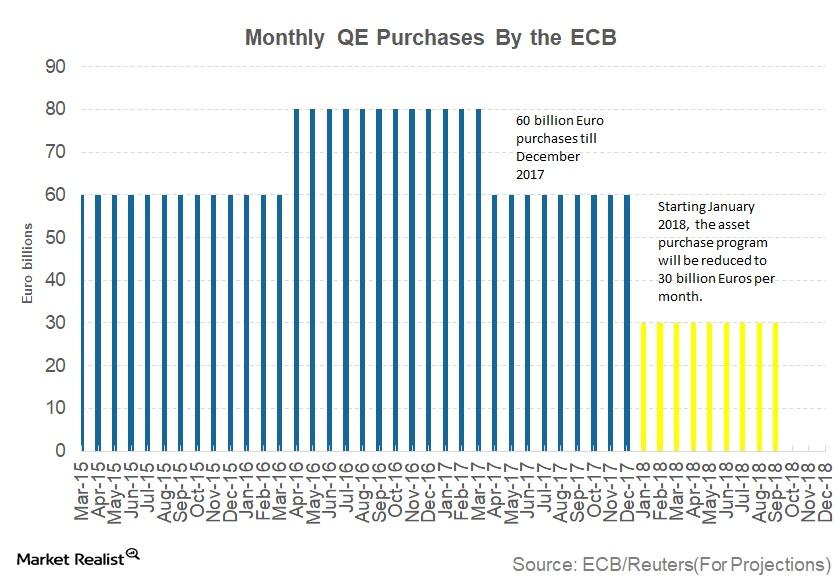

Update from the European Central Bank’s October Policy Statement

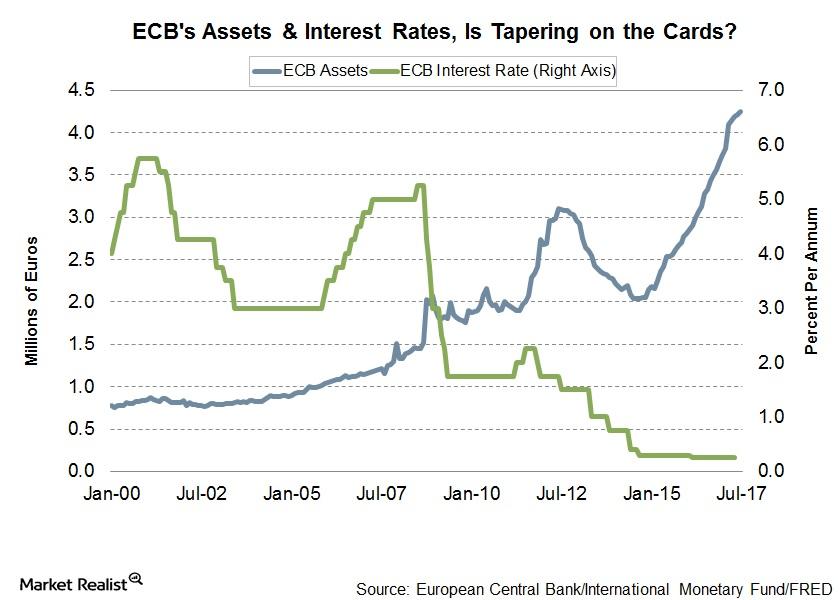

In the ECB’s (European Central Bank) October policy meeting, its laid out its plans for the QE (quantitative easing) program.

How ECB Tapering Could Impact European Bond Markets

The European bond market’s reaction to the ECB’s (European Central Bank) September 7 statement has so far been positive.

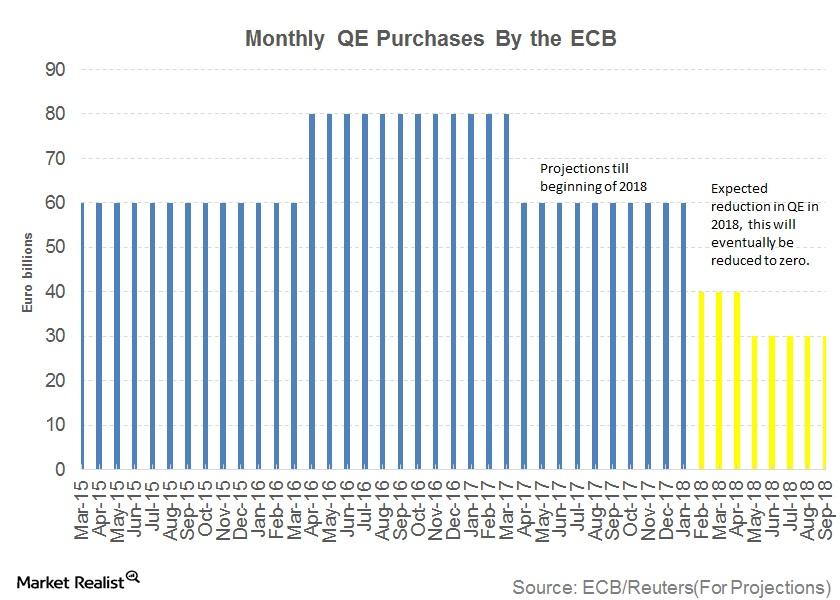

Will ECB’s Tightening Lead to Bond Market Sell-Off?

If the European economy continues to improve at the current pace, the QE program could be scaled down to 40.0 billion euros per month.

Confused Markets: Inside the ECB’s Struggle amid Miscommunication

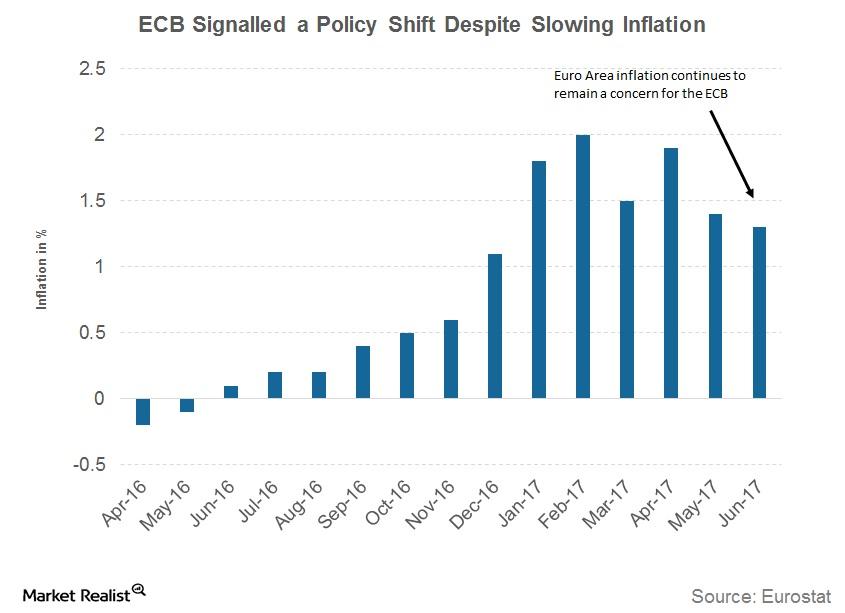

The ECB (European Central Bank) in its recent monetary policy meeting on June 8 left its main refinancing rate at 0% and the interest rate at 0.25%.

Why the ECB Closed the Door on Further Rate Cuts

The ECB (European Central Bank) left interest rates unchanged at 0% in the rate-setting meeting that was held on Thursday, June 8.

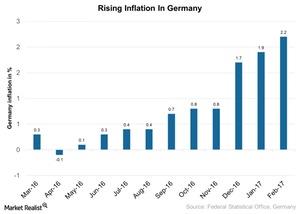

Germany’s Economic Growth and the Role of Rising Inflation

Germany’s expected rise in inflation is concerning as the cost of borrowing has increased across Europe—and this amid all the political uncertainty.