Inside the Potash Margins of 5 Major Fertilizer Companies

Given the growth in potash shipments and the increase in price realization, it’s natural that the margins of potash producers improved YoY in 2Q17.

Aug. 21 2017, Updated 7:36 a.m. ET

Potash margins

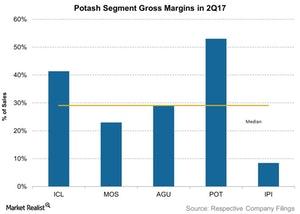

Given the growth in potash shipments and the increase in price realization for this fertilizer, it’s natural that the margins of potash producers (NANR) improved on a YoY (year-over-year) basis in 2Q17. PotashCorp continues to be the leader among these companies (see chart below), with a gross margin of 53% in its potash segment.

Margin by company

The median margin for the potash segments of the above five companies in 2Q17 stood at 29%, marking a steep rise from 12% in 2Q16. PotashCorp’s (POT) margin of 53% in its potash segment represents a YoY rise over its margin of 41% in 2Q16. Notably, PotashCorp is one of the lowest-cost producers of potash fertilizers, which gives it the benefit of having fatter margins than its peers.

Israel Chemicals’ (ICL) gross margin expanded to 41% in 2Q17, up from 18% in 2Q16. Agrium (AGU) saw a significant expansion in its potash margin, rising from 12% in 2Q16 to 29% in 2Q17.

Mosaic’s (MOS) potash segment margin expanded to 23% in 2Q17 from 12% in 2Q16, while Intrepid Potash (IPI), which had the lowest margin among the above companies, saw its potash margin rise to 8% in 2Q17, compared with -13% in 2Q16.

To be sure, improving potash prices have been favorable for these producers, and now, the outlook for potash is far more positive.

In the concluding few parts of this series, we’ll discuss phosphate fertilizers.