This Is Why the US Dollar Could Slide Further

US Dollar index reaches a 14-month low The US Dollar Index (UUP) continued with its fall as investors preferred major peers. In the week ended July 21, the US Dollar Index closed at 93.78, falling 1.7% from the week prior. It is headed for its fifth consecutive month of loss this year. Conflicting news from […]

July 28 2017, Updated 8:31 a.m. ET

US Dollar index reaches a 14-month low

The US Dollar Index (UUP) continued with its fall as investors preferred major peers. In the week ended July 21, the US Dollar Index closed at 93.78, falling 1.7% from the week prior. It is headed for its fifth consecutive month of loss this year. Conflicting news from the economy and the US Fed are dragging down the dollar. Though the US Fed is signaling another rate hike this year, this month’s weak economic data in the form of retail sales (XRT), consumer prices, and manufacturing activity, has cast doubts on the Fed’s ability to raise rates again. Whereas housing data (ITB) bounced with building permits rising last week, it was not sufficient to revive investors’ appetite for the US dollar (USDU).

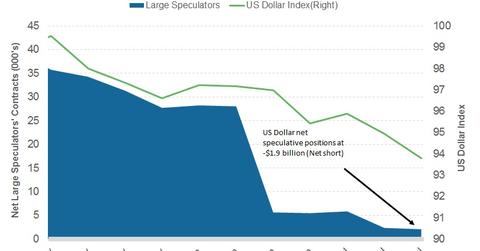

Speculator positions bearish for the first time since May 2016

According to the CFTC’s (US Commodity Futures Trading Commission) latest Commitments of Traders report, large speculators and traders have turned bearish on the US dollar for the first time in 14 months. Reuters calculations show that net US dollar (USDU) positions stood at -$1.9 billion last week, compared with $62 million the week prior. This amount represents the US dollar’s contracts against the combined contracts of the euro (FXE), British pound (FXB), Japanese yen (FXY), Australian dollar (FXA), Canadian dollar (FXC), and Swiss franc. The recent fall indicates that traders are betting on further declines in the US dollar against the major currencies in the near term.

Will the US dollar continue to slide?

The US economic calendar is full this week. Reports on existing home sales, new home sales, consumer confidence, and core durable goods orders are due. Also, the Fed is meeting, though interest rates are expected to remain unchanged. Investors could be looking for clues about the Fed’s next move and balance sheet trimming. If there are no major surprises this week, we can expect the US dollar to remain under pressure.