US Gasoline Consumption Rose in May

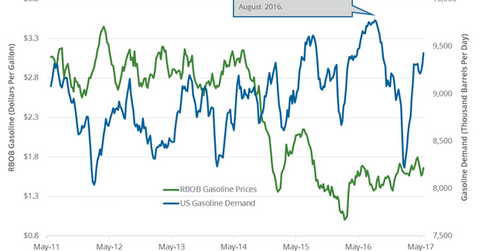

The EIA estimates that US gasoline consumption averaged 9,600,000 bpd (barrels per day) in May 2017—0.16 MMbpd higher than the same period in 2016.

June 7 2017, Updated 12:35 p.m. ET

US gasoline consumption

The EIA (U.S. Energy Information Administration) estimates that US gasoline consumption averaged 9,600,000 bpd (barrels per day) in May 2017—0.16 MMbpd higher than the same period in 2016. The rise in gasoline demand is bullish for gasoline and crude oil (USO) (ERY) (ERX) prices.

Higher gasoline and crude oil prices have a positive impact on refiners and oil producers’ earnings like Western Refining (WNR), Marathon Petroleum (MPC), Valero (VLO), Matador Resources (MTDR), and SM Energy (SM).

US gasoline consumption estimates for 2017

The EIA released its monthly STEO (Short-Term Energy Outlook) report on June 6, 2017. It estimates that US gasoline consumption will average 9,340,000 bpd 2017—0.1% higher than previous estimates. The EIA also estimates that US gasoline consumption will average 9,370,000 bpd 2018—0.1% higher than previous estimates. US gasoline consumption could hit a record in 2018. US gasoline consumption averaged 9,330,000 bpd in 2016 and hit a record.

The EIA estimates that US gasoline consumption could hit a record high this summer. It also estimates that gasoline consumption from June 2017 to August 2017 could be 0.4% higher than the same period in 2016.

Gasoline demand drivers

Market surveys project that there will be a record number of US travelers this summer, which would drive gasoline demand. Record gasoline consumption could support gasoline prices, which would benefit crude oil prices.

In the last part of this series, we’ll take a look at China’s crude oil imports and demand in 2017.