How Silver Miners Rank Based on Debt Repayment Capacity

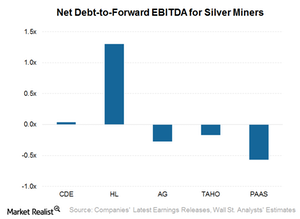

Coeur Mining (CDE) has a net debt-to-forward-EBITDA ratio of 0.40x, which seems comfortable. Hecla Mining’s (HL) ratio is slightly higher at 1.3x.

June 2 2017, Updated 9:06 a.m. ET

Paying debt through earnings

If a company has the ability to repay its debt through its earnings, debt can provide leverage, which can help it outperform during times of higher metal prices. As such, it’s important to estimate if a company is in a position to repay its debt through its earnings. The net debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) ratio is one such measure. It indicates how many years it will take for a company to repay its debt.

EBITDA is useful for comparing companies with different capital structures. For the purpose of our ratios, we’ll use forward EBITDA, which captures a company’s earnings capacity in the future. This is essential since we’re determining the capacity to repay debt from its ongoing earnings.

Repayment capacity

As we saw previously, of the five silver companies under discussion, three of them—Tahoe Resources (TAHO), First Majestic Silver (AG), and Pan American Silver (PAAS)—are in net cash positions. Coeur Mining (CDE) has a net debt-to-forward-EBITDA ratio of 0.40x, which seems comfortable. Hecla Mining’s (HL) ratio is slightly higher at 1.3x, which is not a cause for concern. As we’ve discussed previously, most of its debt is long-dated with a robust cash position.

Together, Tahoe and Coeur make up 26.5% of the Global X Silver Miners ETF (SIL). Investing in the iShares Silver Trust (SLV) is another way to access precious metals. Leveraged funds such as the ProShares Ultra Silver (AGQ) and the Direxion Daily Gold Miners Bull 3X ETF (NUGT) also provide exposure to the changes in precious metal prices, although they’re highly leveraged. We’ll analyze free cash flow upsides for the five silver mining companies in the next part of this series.