Puerto Rico’s GDP Is Falling amid Low Expectations for 2017

For years, Puerto Rico has been using tax incentives to attract corporations to do business in its region. Over the last four decades, the agricultural economy has shifted toward the manufacturing and services sectors.

May 8 2017, Published 3:00 p.m. ET

Economic activity in Puerto Rico

For years, Puerto Rico has been using tax incentives to attract corporations to do business in its region. Over the last four decades, the agricultural economy has shifted toward the manufacturing (FYT) (RZV) and services sectors (KRE) (KBE).

In the last decade, structural change in the region has intensified due to a significant reduction in labor-intensive industries and the development of capital-intensive industries (XSW) and knowledge-intensive sectors such as biotechnology (IHF). Liberal tax laws have also fueled the spread of textile and pharmaceutical factories in the region.

Some multinationals with significant assets in Puerto Rico include Abbott Laboratories (ABT), Johnson & Johnson (JNJ), and Medtronic (MDT). These companies could reduce their tax rates by ~2% through their presences in Puerto Rico.

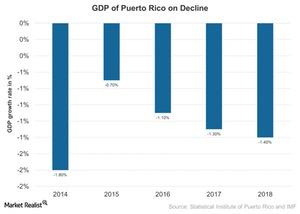

Let’s take a look at Puerto Rico’s GDP growth over the last few years in the chart above.

Low economic activity in Puerto Rico

A repeal of tax incentives in 2006 led to the shifting of manufacturing bases and employment back to the United States. In the chart above, we can see that Puerto Rico’s economic activity has been falling since 2006. The change in the tax code repealing key tax incentives in 1996 had resulted in manufacturing bases and employment leaving the country. As a result, without strong domestic demand, the reduction in tax revenue led to a contraction in economic activity in Puerto Rico.

Over the last decade, Puerto Rico has borrowed money by issuing municipal bonds (SHYD) (HYD) and using funds to compensate for falling government revenue. It’s done so to prevent layoffs and deep cuts in its services. Over the past decade, Puerto Rico accumulated ~$72 billion in public debt, ~70% of its GDP. Its economy is also burdened with unfunded pension obligations to the tune of $49 billion. This makes up ~200% in tax revenue.

According to the latest IMF report as of April 2017, Puerto Rico’s economy will continue to contract at rates of 1.3% and 1.4% in 2017 and 2018, respectively.

Investment impact

Many ETFs have emerged in the United States to benefit from the tax-free natures of the bonds issued by Puerto Rico and other such municipalities. Some of these funds include the iShares National AMT-Free Municipal Bond ETF (MUB), the State Street SPDR Barclays Short Term Municipal Bond ETF (SHM), and the Invesco PowerShares VRDO Tax-Free Weekly ETF (PVI).

Let’s look at the structural problems in Puerto Rico resulting from its reduced economic activity in our next article.