iShares National AMT-Free Muni Bond

Latest iShares National AMT-Free Muni Bond News and Updates

What Caused the Muni Defaults in 2016?

In 2016, Puerto Rico defaulted on constitutionally guaranteed GO (general obligation) bonds. On May 3, 2017, Puerto Rico filed for Title III bankruptcy.

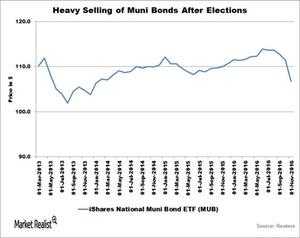

A Glance at Muni Bonds’ Performance in 2016

The performance of municipal bonds has fallen since the 2016 election, as President Trump’s tax reform and infrastructure spending plans have caused some concern among investors.

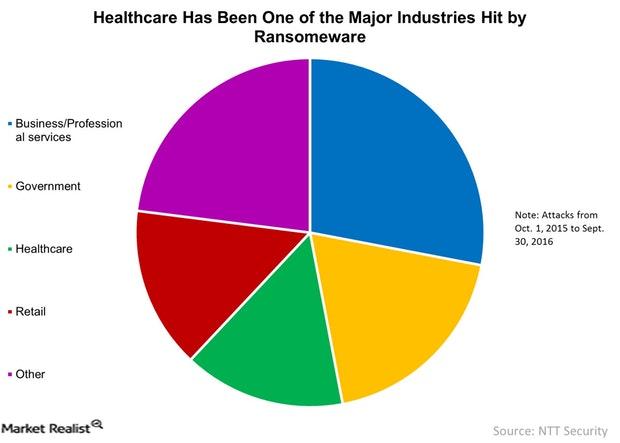

How Municipalities Can Prevent Cyber Attacks

One possible driver to action could simply be alerting the public through their local media outlets just what havoc can be, and has been, wrought by cyberattacks.

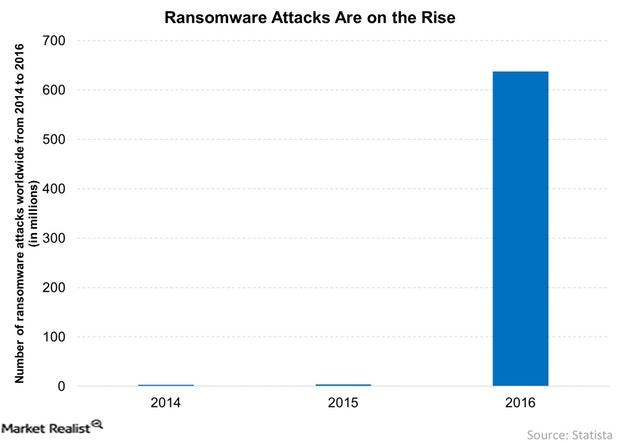

Ransomware Attacks Are on the Rise

We are all potentially at risk of cyberattack – directly or indirectly. When it comes to municipalities, this may not always be obvious to the average state or city taxpayer.

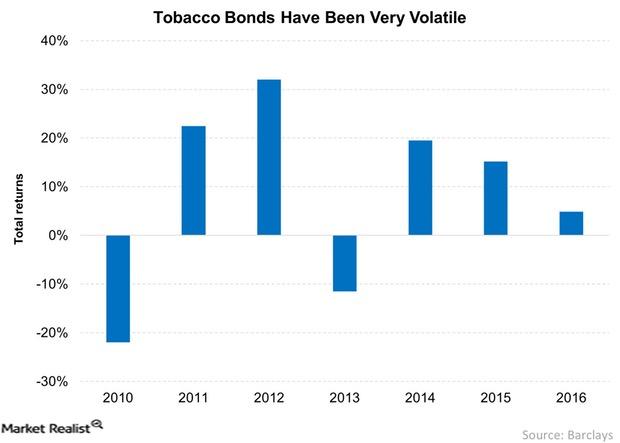

Do Tobacco Bonds Warrant a Place in Your Portfolio?

Tobacco bonds have been volatile in the last seven years. Falling MSA payments caused the volatility. Tobacco bonds offer relatively good cash flow returns.

Is There an Opportunity in a Muni Sell-Off?

With their high yields, low prices, and tax-efficient returns, muni bonds (HYD) (ITM) could be available to investors at a dirt cheap rate in the coming months.

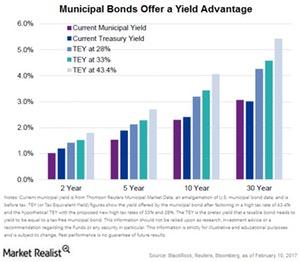

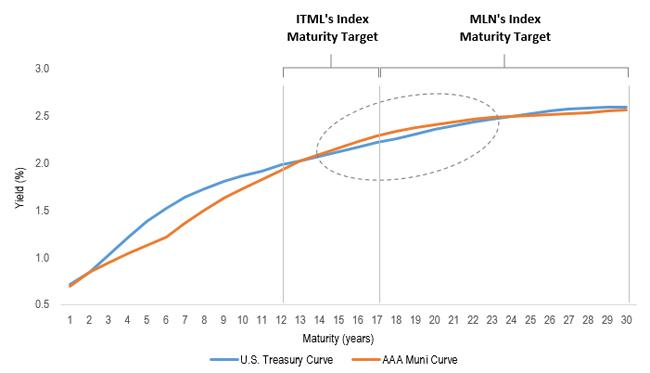

Attractive Relative Yields from Muni Bonds

We believe recent municipal bond weakness is an opportunity to put money to work at lower prices than what we have seen for some time. High quality, triple-A rated municipal bonds with maturities between 13 to 23 years currently offer higher nominal yields than 10-year U.S. Treasuries, making them particularly attractive, as shown in the […]

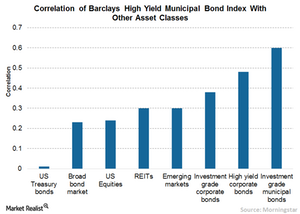

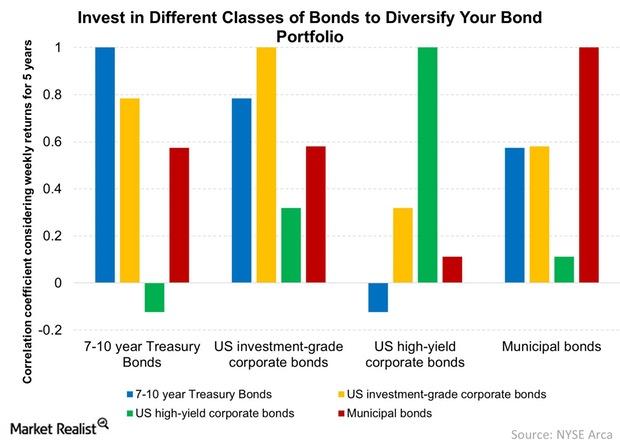

Municipal Bonds Are the Ballast to Equity Risk

Historically, investment-grade and high-yield municipal bonds (MUB) have a very low correlation with most other asset classes.

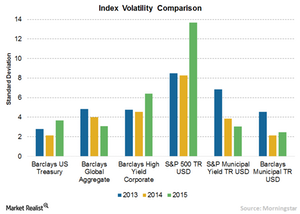

Why Municipal Bonds Are Immune to Market Volatility

Generally, municipal bonds (SUB) are immune to market volatility, thus providing considerable support to a portfolio.

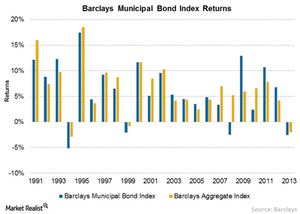

Yield Is the Workhorse of Municipal Bond Returns

Over the years, average returns from municipal bonds (CMF) are in line with the broader index. They outperformed in some years and underperformed in others.

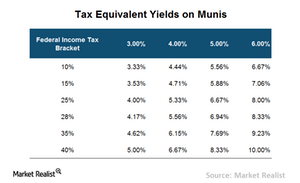

Are Municipal Bonds Really for Me?

Municipal bonds (MUB) have provided an excellent return in the past year. The returns are even better if we account for their tax benefits.

Own Bonds across Credit Quality to Diversify Your Portfolio

Adding bonds across credit classes helps diversify your bond portfolio. The weight of each category depends on your risk appetite and the business cycle.Industrials Must-know: Do credit spreads only represent credit risk?

While credit spreads do give you a good picture of the credit risk of one bond compared to another, it’s not the only factor they represent.