Eli Lilly’s 1Q17 Earnings: Strattera and Other Neuroscience Products

Strattera, a drug for attention-deficit hyperactivity disorder, reported a 4% increase in revenues to $196.2 million in 1Q17, compared to $188.1 million in 1Q16.

May 1 2017, Updated 10:38 a.m. ET

Neuroscience franchise

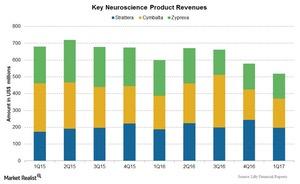

Another franchise from Eli Lilly & Co.’s (LLY) Human Pharmaceuticals segment is the neuroscience franchise. Key drugs in this segment include Strattera, Zyprexa, and Cymbalta.

Strattera

Strattera, a drug for attention-deficit hyperactivity disorder, reported a 4% increase in revenues to $196.2 million in 1Q17, compared to $188.1 million in 1Q16. The drug’s US sales increased 5%, while its international sales increased 3% during 1Q17. Strattera competes with Shire’s (SHPG) Vyvanse and Intuniv, as well as Johnson & Johnson’s (JNJ) Concerta.

Other drugs for neuroscience franchise

Other drugs for the neuroscience franchise include Cymbalta and Zyprexa.

Cymbalta

Cymbalta is an antidepressant used for the treatment of depression and anxiety, as well as bone and muscle pain. The sales of Cymbalta decreased ~12% to $174.6 million in 1Q17, compared to ~$198.7 million in 1Q16. The drug’s US sales rose 46% to $34.1 million, while its international sales fell 20% to $140.5 million during 1Q17. Cymbalta’s revenues declined due to a loss of exclusivity in Europe and Canada.

Zyprexa

Zyprexa is an antipsychotic drug used in the treatment of conditions such as schizophrenia or bipolar disorder. The sales for Zyprexa decreased ~31% to $147.5 million during 1Q17, compared to $212.8 million for 1Q16. The drug’s US sales decreased 38% to $23.7 million, while its international sales decreased 29% to $123.8 million during 1Q17.

Zyprexa has been exposed to generic competition in Japan since June 2016 due to its patent expiry. For Japanese markets, Zyprexa reported a 52% decline in revenues during 1Q17. Zyprexa has generic competition from Mylan (MYL) and Teva Pharmaceuticals (TEVA).

To divest company-specific risk, investors can consider the iShares Russell Top 200 ETF (IWL), which holds 0.5% of its portfolio in Lilly.