How Yingli Solar’s Costs Affected Its Gross Margin in 2Q16

Yingli Solar’s (YGE) total operating expenses in 2Q16 were about $45.4 million, compared to $43.9 million in 1Q16 and $56.3 million in 2Q15.

Aug. 30 2016, Updated 8:04 a.m. ET

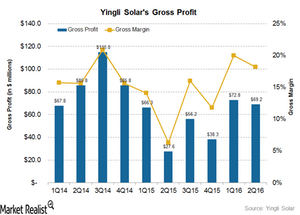

Yingli Solar’s gross margin

In 2Q16, Yingli Solar (YGE) reported a gross profit of $69.2 million, compared to $72.8 million in 1Q16. On a YoY (year-over-year) basis, the company’s gross profit increased by nearly 151% from $27.6 million in the second quarter of 2015.

Yingli Solar’s gross margin for 2Q16 came in at 18.2%, against analysts’ expectations of 18.7%. Yingli Solar had gross margin guidance in the range of 18%–20% for 2Q16. The company reported gross margins of 20.0% and 6.3% in 1Q16 and 2Q15, respectively.

According to company filings, the sequential decrease in gross margin is primarily due to a decline in ASP (average selling price) of its PV modules in 2Q16 compared to 1Q16. However, the year-over-year increase in gross margin is mainly due to a decrease in overall cost of revenue from ~$410 million in 2Q15 to ~$311 million in 2Q16.

Selling, general, and administrative expenses

Yingli Solar’s selling expenses were $23.3 million in 2Q16, which represents an ~18% decrease from $28.3 million in 1Q16. Also, its selling expenses decreased by nearly 43% on a YoY basis.

Meanwhile, its G&A (general and administrative) expenses came in at about $10.6 million in 2Q16—a 20% decrease from $13.3 million in 1Q16. However, the company’s G&A expenses increased substantially from ~$0.3 million in 2Q15.

Overall operating expenses

Yingli Solar’s (YGE) total operating expenses in 2Q16 were about $45.4 million, compared to $43.9 million in 1Q16 and $56.3 million in 2Q15. However, operating expenses came in at 11.9% of net revenues in 2Q16, compared to 12.0% of net revenues in 1Q16 and ~12.9% of net revenue in 2Q15.

According to company filings, the marginal increase in operating expenses on a quarter-over-quarter basis is mainly due to increase in R&D (research and development) expenses and an increase in provisions for inventory purchase commitments. However, the decrease in module shipping costs resulted in lower operating expenses on a YoY basis.

R&D expenses are required for upstream solar (TAN) companies such as First Solar (FSLR), SunPower (SPWR), SunEdison (SUNEQ), Canadian Solar (CSIQ), Trina Solar (TSL), and Yingli Solar to remain competitive. Notably, Yingli Solar more than doubled its R&D expenditure from $3.6 million in 1Q16 to $9.5 million in 2Q16.

Next, let’s look at Yingli Solar’s operating and net income for 2Q16.