US Crude Oil Inventories Fall Again: How Is Crude Oil Reacting?

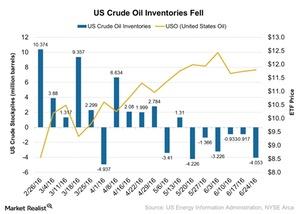

According to the U.S. Energy Information Administration’s report on June 29, 2016, US crude oil inventories fell by 4.1 MMbbls in the week ended June 24, 2016.

Nov. 20 2020, Updated 12:57 p.m. ET

US crude oil inventories fell by 4.1 million barrels

According to the U.S. Energy Information Administration’s report on June 29, 2016, US (QQQ) (IWM) crude oil inventories fell by 4.1 MMbbls (million barrels) in the week ended June 24, 2016, compared to a fall of 0.92 MMbbls in the previous week. The Market expected a fall of 2.3 MMbbls. The fall beat market expectations, declining for the sixth consecutive week.

The United States Oil ETF (USO) rose by 2.8%, and the ProShares Ultra Bloomberg Crude Oil ETF (UCO) rose by 5.3% on June 29, 2016. The higher-than-expected fall in crude oil inventories drove crude oil’s movement on the day.

Crude oil inventories fall for the sixth consecutive week

In the last six consecutive weeks, crude oil inventories have shown downward movement. Crude oil’s price has shown a strong rally since February 12, 2016. On February 11, 2016, crude oil (UWTI) (BNO) touched a multiyear low of $26.11 per barrel. Global markets (VTI) (VEU) (ACWI) also recovered from their respective lows on February 11, 2016. The Federal Reserve’s dovish stance was mainly responsible for these market movements.

The fall in crude oil inventories is a welcome sign for crude oil, erasing the fear of a global supply glut. Demand for crude oil is expected to rise in the near future, further driving crude oil’s movements.

Higher crude oil prices will benefit crude oil producers. You can read Drop in Crude Oil Inventories Boosts Oil Prices to know more.

In the next part of this series, we’ll analyze the performance of the US GDP for 1Q16.