Jeffrey Gundlach: Buy Mortgage REITs, Short Utilities

Gundlach thinks that investors should short low volatility equity funds. People invest in them thinking that they’re safe, but they aren’t.

Nov. 22 2019, Updated 7:20 a.m. ET

Gundlach thinks investors should long mortgage REITs

Jeffrey Gundlach thinks that mortgage REITs should see better days ahead because:

- They’re interest rate sensitive.

- They’re yield proxies.

The iShares Mortgage Real Estate Capped ETF (REM) is a popular mortgage REIT ETF. The ETRACS Monthly Pay 2xLeveraged Mortgage REIT ETN Series B ETF (MRRL) also provides exposure to mortgage REITs with 2x leverage.

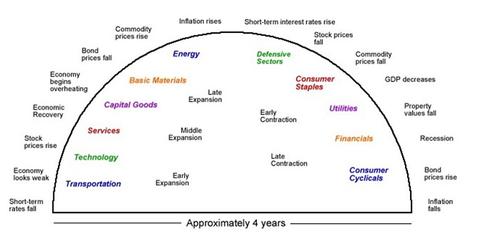

Business cycle seems to support Gundlach’s view

In our recent series on Business Cycle Investing, we highlighted how utilities saw their glory days in the first quarter this year. They outperformed all of the other sectors in the S&P 500 (SPY) (VFINX). The Utilities Select Sector SPDR ETF (XLU) was at $43 at the start of the year. Now, it’s trading at close to $50 as of May 4—about a 15%–16% return year-to-date. So, “shorting them is a good entry point,” says Gundlach.

However, given the fact that we’re towards the end of the current business cycle, we should see utilities (XLU) taking a back seat. Consumer and financial firms will outperform instead. Gundlach advised investors to go long on mortgage REITs (REM). They’re lending institutions that are part of the financial sector (XLF) and short utilities (XLU) that saw their highs and might reverse the trend.

What to short?

Gundlach also thinks that investors shorting low volatility equity funds is a good idea. People invest in them thinking that they’re safe, but they aren’t. That’s what happened with subprime, recalls Gundlach. The PowerShares S&P 500 Low Volatility ETF (SPLV) and the iShares MSCI USA Minimum Volatility (USMV) are funds offering that kind of exposure. These funds returned 4.3% and 5.2%, respectively, to investors as of April 30, 2016.

Gundlach also shed light on the potential of earning a 35% return by this income arbitrage. We’ll discuss this in the next part.