What’s Allergan’s Growth Strategy?

Allergan’s new industry model, “growth pharma,” is based on identifying five characteristics that boost company growth and differentiate it from its peers.

May 27 2016, Published 4:16 p.m. ET

Allergan’s growth strategy

Actavis acquired Allergan (AGN) in March 2015, and the company changed its name from Actavis to Allergan.

Allergan has entered into an agreement with Teva Pharmaceutical Industries (TEVA) for the divestiture of its generic pharmaceutical business to Teva. The deal is expected to close by June 2016.

Allergan terms its new industry model as “growth pharma.” It’s based on identifying five characteristics that both boost company growth and differentiate it from its peers, the big pharma companies. The growth pharma model will be discussed in the next article.

Termination of Pfizer-Allergan deal

Two big pharmaceutical companies, Pfizer (PFE) and Allergan, announced their potential merger in November 2015. However, the deal was terminated in April 2016 following the actions of the U.S. Department of the Treasury regarding adverse tax law changes.

Changes in recent years

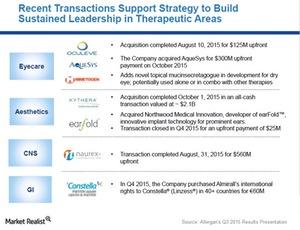

With the target of becoming a new leader in the pharmaceuticals industry, Actavis—now Allergan—has undergone many small and large acquisitions and divestitures in recent years apart from the Actavis-Allergan merger. Some of its recent acquisitions and divestitures include:

- acquisition of AqueSys, a clinical-stage medical device company focused on ocular implants, in October 2015

- acquisition of Kythera, a company focused on aesthetics, in October 2015

- acquisition of Oculeve, a company focused on dry eyes products, in August 2015

- divestiture of its respiratory business, acquired as part of its Forest Laboratories transaction, to AstraZeneca (AZN)

- divestiture of Aptalis Pharmaceutical Technologies, also known as Pharmatech, acquired as part of its Forest Laboratories transaction

Investors can consider ETFs such as the Vanguard Growth ETF (VUG), which holds ~1.0% of its total assets in Allergan, or the Health Care Select Sector SPDR ETF (XLV) which holds ~3.4% of its total assets in Allergan, in order to divest their risk.