Why Is Brent-WTI Crude Oil Spread Widening in 2016?

US crude oil production has not slowed down in 2016 as expected, so prices started to fall more than expected in 2016. The Brent-WTI spread widened in February.

Nov. 20 2020, Updated 4:28 p.m. ET

Brent and WTI crude oil in 2016

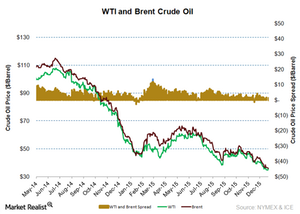

The US benchmark March WTI (West Texas Intermediate) crude oil fell by almost 6% and settled at $27.94 per barrel on Tuesday, February 9, 2016. Global benchmark Brent crude oil futures fell 11% and closed at $30.32 per barrel. For more details on the oil price action, read the first part of the series.

The current Brent-WTI spread is at $2.36 per barrel as of Tuesday, February 9, 2016. Brent and WTI crude oil prices settled at $37.72 and $36.76 per barrel, respectively, on January 4, 2016. The Brent-WTI crude oil spread was $1.04 per barrel on the first trading day of 2016.

Brent-WTI crude oil spread widens in February

The lifting of the US crude oil export ban boosted US crude oil prices in early 2016. US crude oil prices also rose due to slowing US crude oil production. However, the long-term oversupply concerns and record production from OPEC (Organization of the Petroleum Exporting Countries) weighed on Brent crude oil prices. So Brent prices fell more than WTI, making the Brent-WTI spread narrow in early 2016.

US crude oil production has not slowed down in 2016 as expected. So US oil prices started to fall more than expected in 2016. But speculation of a collective production cut from OPEC and non-OPEC boosted Brent more than WTI in the last two weeks. However, the fading ties of production cuts are putting pressure on oil prices. Rising supplies are also putting pressure on US oil prices. So the Brent-WTI spread widened in February.

The widening Brent-WTI spread benefits oil refiners such as Phillips 66 (PSX), Western Refining (WNR), Alon USA Partners (ALDW), and Northern Tier Energy (NTI). But a narrow spread benefits oil producers such as Laredo Petroleum (LPI), Whiting Petroleum (WLL), and Pioneer Natural Resources (PXD). They also benefit upstream MLPs such as Memorial Production Partners (MEMP), Vanguard Natural Resources (VNR), and Atlas Resource Partners (ARP).

ETFs and ETNs such as the First Trust Energy AlphaDEX Fund (FXN), the United States Oil Fund (USO), the iPath S&P GSCI Crude Oil Total Return ETN (OIL), and the ProShares UltraShort Bloomberg Crude Oil ETF (SCO) are also influenced by the rise and fall in oil prices.

In the next part of this series, we’ll look at the global supply and demand gap in 2016 and 2017.