Understanding Toll Brothers’ Land Acquisition Strategy

Toll Brothers’ use of land option agreements reduces financial risks associated with long-term land holdings. The land acquisition strategy of other homebuilders also involves option contracts.

Sept. 23 2015, Updated 11:05 a.m. ET

Option contracts

Toll Brothers (TOL) mainly acquires land to complete sales of housing units. The company manages a portion of the risk of controlling land positions through the use of land option contracts, which enables it to defer acquiring portions of properties owned by land sellers until it decides to exercise its option.

Toll Brothers’ use of land option agreements reduces financial risks associated with the long-term land holdings. The land acquisition strategy of other homebuilders such as Lennar (LEN), D.R. Horton (DHI), and PulteGroup (PHM) also involves option contracts.

Significant reduction in land lots

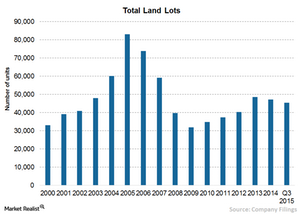

In response to the 2006–2011 market downturn, Toll Brothers (TOL) renegotiated or canceled many of its land purchase contracts. In addition, the company sold certain non-strategic land parcels, which reduced its home sites from a high of 91,200 as of April 30, 2006, to 47,167 as of the end of fiscal 2014.

Economic recovery led to improvement in land lots

During fiscal 2013 and 2014, Toll Brothers (TOL) acquired 12,462 and 3,936 home sites (net of options terminated and home sites sold), respectively.

As of the end of fiscal 2014, Toll Brothers (TOL) controlled 47,167 home sites compared to 48,628 home sites in 2013 and 40,350 in 2012.

Of the 47,167 total home sites Toll Brothers (TOL) controlled in 2014, the company owned 36,224 and controlled 10,943 through options.

Land parcels for rental projects

Over the past several years, Toll Brothers (TOL) has acquired control of a number of land parcels for rental apartment projects, including two student housing sites, totaling approximately 4,850 units.

These projects, which are located in the metro Boston to metro Washington, DC, corridor, are being developed under the brand names Toll Brothers Apartment Living and Toll Brothers Campus Living.

Investors looking for diversification in the homebuilding sector can consider ETFs like the SPDR S&P Homebuilders ETF (XHB) and the iShares US Home Construction ETF (ITB). Toll Brothers (TOL) forms 7.78% of the holdings of the iShares US Home Construction ETF (ITB).

In the next part of our series, we’ll examine Toll Brothers’ acquisition strategy.