Must-read: Understanding gold companies’ gold equivalent ounces

It’s important to understand GEO or gold equivalent ounces because gold companies like Goldcorp (GG), Barrick Gold (ABX), Newmont Mining (NEM), and Kinross (KGC), measure their production and reserves in different ways. You need to make sure you’re comparing apples to apples.

Sept. 25 2014, Updated 5:00 p.m. ET

Comparing apples to apples

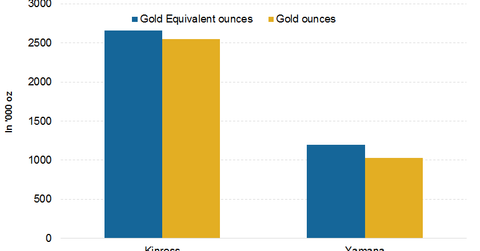

It’s important to understand GEO or gold equivalent ounces because gold companies like Goldcorp (GG), Barrick Gold (ABX), Newmont Mining (NEM), and Kinross (KGC) measure their production and reserves in different ways. You need to make sure you’re comparing apples to apples. Some companies report gold ounces while others report gold equivalent ounces or GEO.

What is GEO?

Companies that produce multiple metals usually report GEO. GEO includes silver, copper, and zinc ounces. This number is then converted to a gold equivalent based on a ratio of the average spot market price for the commodities each year.

For example, say a company produces 1,000 ounces of gold and 40,000 ounces of silver. The prices for the metals are $1,300 per ounce for gold and $20 per ounce for silver. The ratio to convert silver into GEO would be 65 (1300/20), which would result in 615 more ounces (40,000/65) and a total of 1,615 ounces (1,000+615) of GEO.

Why should you care?

At times, it becomes necessary to look beyond GEO and see how much gold ounces, silver ounces, et cetera a company produces. That’s because the drivers for different commodities are different. If we know what exactly the production of each type of metal is, we can use cost per unit assumptions and price assumptions accordingly.

It’s also important for you to note the price at which the GEO was calculated if there’s a significant difference between the current spot prices and the prices the company used. You might want to do your own calculations using current prices.

You can also consider investing in gold-backed ETFs like the SPDR Gold Shares (GLD) or gold producer–backed ETFs like the Gold Miners ETF (GDX) and Junior Gold Miners ETF (GDXJ).