Federal Spending and Interest Rates: Analyzing the Connection

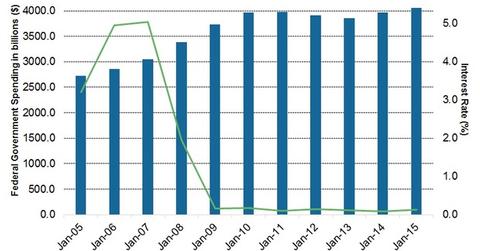

What about the impact on interest rates? Here again, there is no consistent relationship between spending and interest rates.

Sept. 26 2016, Published 2:02 p.m. ET

What about the impact on interest rates? Here again, there is no consistent relationship between spending and interest rates. Looking at annual changes in federal spending against annual changes in the Fed Funds target rate, since 1956 there is no consistently significant relationship. It is just not clear that fiscal spending, even if we get it, will be the dominant theme of 2017.

Market Realist – Fiscal spending: Capacity remains and inflation is dormant

Although there’s no significant relationship between federal spending and the federal funds target rate, appropriate management of government spending may lead to economic growth (IWF)(IWO). Increases in government expenditure lead to increases in the total gross domestic product (or GDP), which will likely help investors and consumers gain confidence in the economy and start spending more. This effect should increase the demand for leveraged loans (BKLN) or credit, so banks tend to raise interest rates.

The government issues debt to fund spending. However, an increase in government debt doesn’t necessarily increase the interest it has to pay on that debt because the central bank can create money and buy the debt if there’s insufficient demand from other operators in the market. The government borrows money and gives it back to consumers in the form of a tax cut.

Fiscal spending should be implemented as long as considerable capacity remains and inflation is dormant. If the economy nears full capacity, the risk of excess stimulus causes an increase in inflation or asset bubbles.

Market Realist – Dividend-paying sectors

On the monetary side, a decrease in the interest rate pumps up profits and allow companies to buy back shares or issue dividends. This effect is bullish for stock markets as well as dividend-paying sectors such as real estate investment trusts (VNQ), utilities (FXU), and consumer staples (XLP).

In the next parts of this series, we’ll discuss how the US presidential elections 2016 could be a source of volatility (VIXY).