Some Donations You Make to GoFundMe Might Qualify as a Tax Deduction

If you donated to GoFundMe at any point during the last year, you may be able to claim it on taxes as a tax deduction. Find out more here.

Feb. 7 2023, Published 12:58 p.m. ET

If you donated to GoFundMe at any point during the last year, whether it was to a person in need or to support a charity, you’re probably wondering if it's tax deductible. A tax deduction is an expense that can be used to reduce your taxable income. The more tax deductions you include on your return (up to the IRS threshold), the less tax liability you’ll have.

So, are donations to GoFundMe tax deductible?

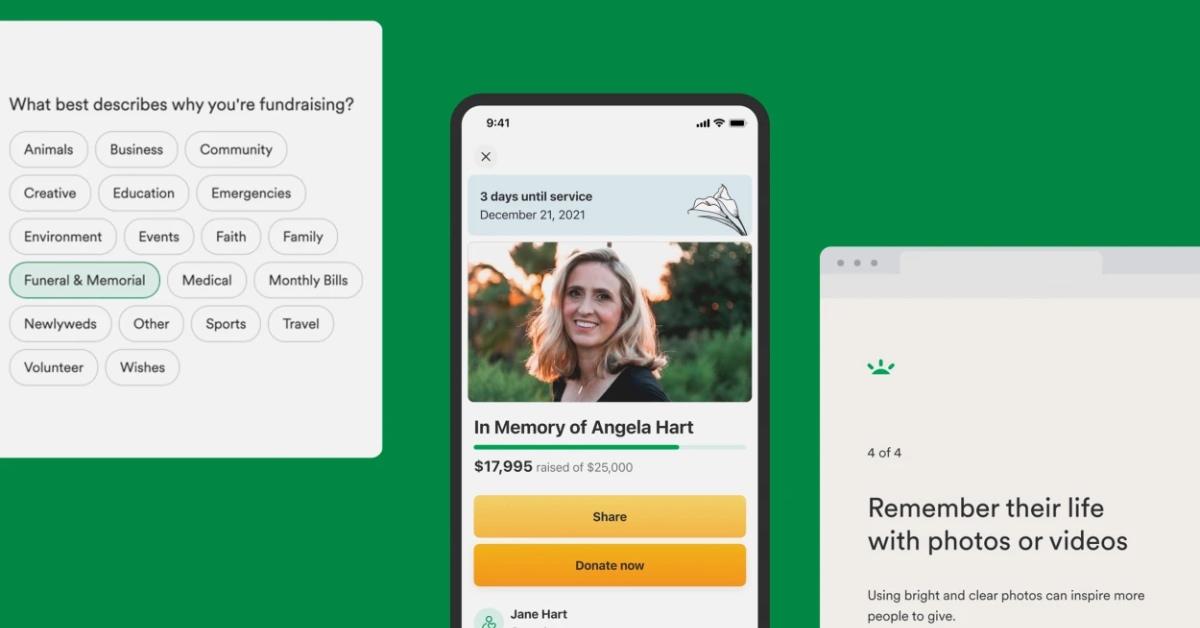

The GoFundMe fundraising platform hosts people from all walks of life, including those in need of money for celebrations, surgery, or to start a business. It also connects charities with donors looking to support one or more causes. Although not all donations made through GoFundMe are guaranteed to be tax-deductible, some are.

Keep reading to find out which GoFundMe donations can be deducted on taxes.

Which GoFundMe donations can I deduct on taxes?

There are hundreds of people and organizations you can donate to on GoFundMe, though not all of your contributions made through the platform may be tax deductible. Any donations made to a personal GoFundMe fundraiser aren’t guaranteed to be tax-deductible, according to the crowd-funding platform’s website.

Donations made to personal GoFundMe fundraisers are usually considered to be “personal gifts” rather than a donation, and therefore, you won’t receive a tax receipt from GoFundMe for them. However, if you make a donation to GoFundMe for a charity fundraiser, meaning it's a registered 501(c)(3) public charity, the company says it's guaranteed to be tax-deductible in the U.S., the U.K., Canada, Australia, and Ireland.

Donations made to charities on GoFundMe will result in tax receipts being issued. GoFundMe tax receipts are issued from the platform’s charity partner, PayPal Giving Fund.

Here's how to tell the difference between charity and personal fundraisers on GoFundMe.

Each GoFundMe campaign will list who the organizer(s) is and the reason for launching the initiative. If the fundraiser is being done on behalf of a charity, the charity’s name will be listed next to the name of the GoFundMe organizer. If you donated to any charities at any time during the tax filing year you are submitting, you should receive a tax receipt that can then be used to deduct the item on taxes.

Also, if you made a donation via GoFundMe.org, this is considered a charitable contribution as it's the company’s registered 501(c)(3) public charity.

How do I deduct GoFundMe donations on taxes?

If you donated to an IRS-designated charitable organization on GoFundMe and received a tax receipt, you’ll need to itemize your deductions in order to include them on your return. The option for non-itemizers to claim charitable contributions as deductions expired on Dec. 21, 2021.

Now, to deduct GoFundMe donations on taxes, you’ll need to file Schedule A, Form 1040, Itemized Deductions. The IRS does give you the option to either itemize your deductions or take the standard deduction.

If you choose to take the standard deduction, which is $12,950 for single filers and $25,900 for married filing jointly, you won’t be able to deduct the charitable donation you made. While you should always keep written proof of your donations, TurboTax says it's especially important for you to have this (from the charity) if you made a cash contribution of $250 or more.

Your receipt should also include the date the donation was made along with the amount.

How much charitable donations can I deduct on taxes in 2022?

The IRS limits your total deductions for charitable contributions to 60 percent of adjusted gross income (AGI) for the year. However, 20 percent and 30 percent thresholds may come into play depending on the circumstances surrounding the donation.

If you have questions regarding deducting charitable donations on taxes, you should consult a tax professional.