Xerox Corporation

Latest Xerox Corporation News and Updates

Xerox CEO Dies, John Visentin's Cause of Death Unknown

Xerox CEO John Visentin has died at age 59. The cause of death is unknown, but he had apparently been ill for some time. Here's what we know so far.

How Ursula Burns Beat the Odds and Made Her Billions

Ursula Burns has made a name for herself by fighting against all odds. What is her success story and what is her net worth?

US Stock Indices Plunge after Oil Prices Rebound

The three US equity indices that we review in this weekly series fell from December 8 to December 15, 2015, after a rebound in oil prices.

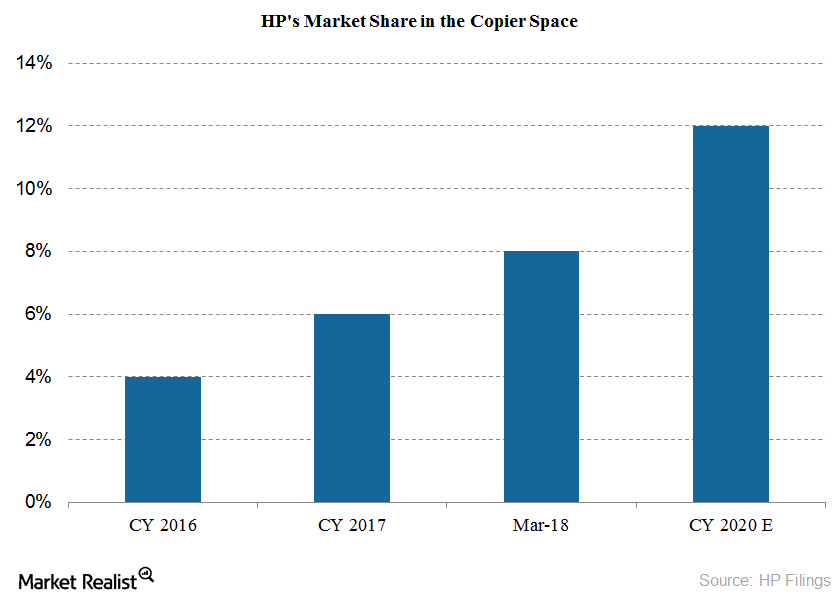

How HP Views the A3 Copier Market

In September 2016, HP (HPQ) announced its intention to acquire Samsung’s (SSNLF) Printing business for $1.1 billion.

Xerox Secures Financing for Proposed HP Takeover

Citigroup, Mizuho Financial Group, and Bank of America agreed to provide a $24 billion bridge loan to Xerox related to its proposed HP (HPQ) takeover.

Xerox Sees Synergies Ahead, Urges HP to Merge

Xerox seems to be determined to acquire HP (HPQ). First, the company has to convince HP shareholders. The company addressed HP shareholders on Monday.

What the Hewlett Packard Split Means for Shareholders

Hewlett Packard split into two $50 billion entities in order to provide value to shareholders, better manage the business, and drive growth.

Get Real: Market Departures and Appeals

In our Get Real market newsletter, we saw iRobot’s lawsuit struggles and Uber’s departure from London. Plus, Amazon might get upstaged by a new startup.