Westmoreland Coal Co

Latest Westmoreland Coal Co News and Updates

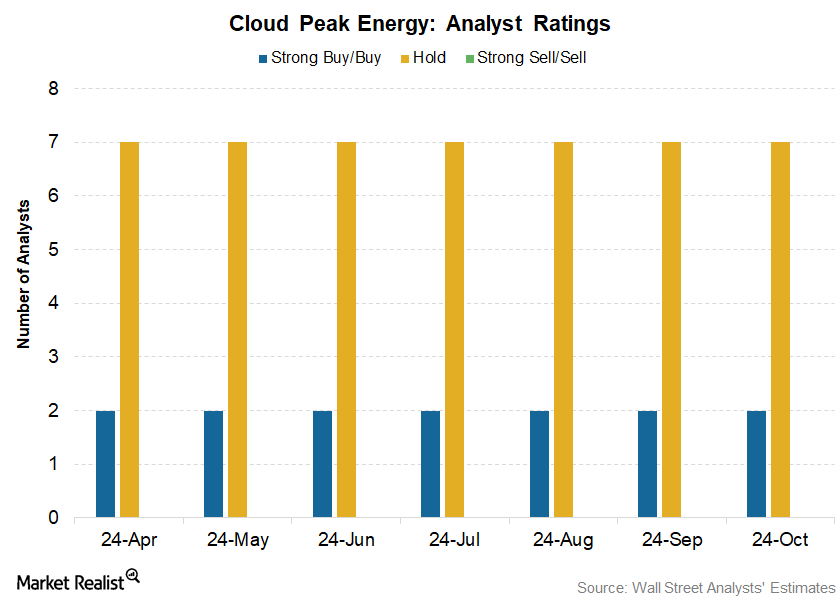

Why Most Analysts Recommend a ‘Hold’ for Cloud Peak Energy

Of the nine analysts covering Cloud Peak Energy (CLD), seven analysts rated its stock as a “hold,” and two gave CLD a “buy” or “strong buy” rating.

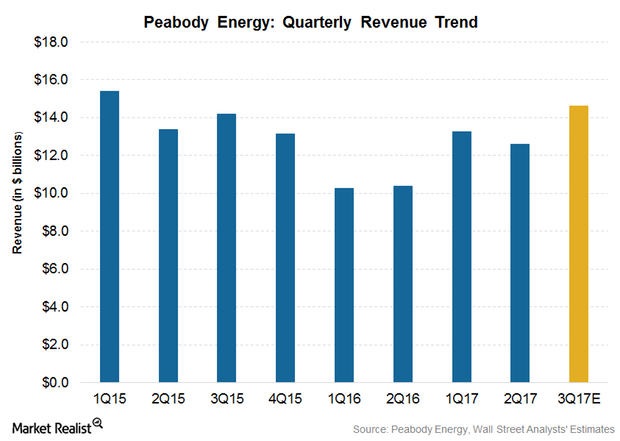

Analysts Expect Peabody Energy’s Revenues to Rise in 3Q17

In 3Q15, Peabody Energy (BTU) reported $1.42 billion in revenues. Analysts anticipate that it will post $1.46 billion in 3Q17 compared to $1.26 billion in 2Q17.

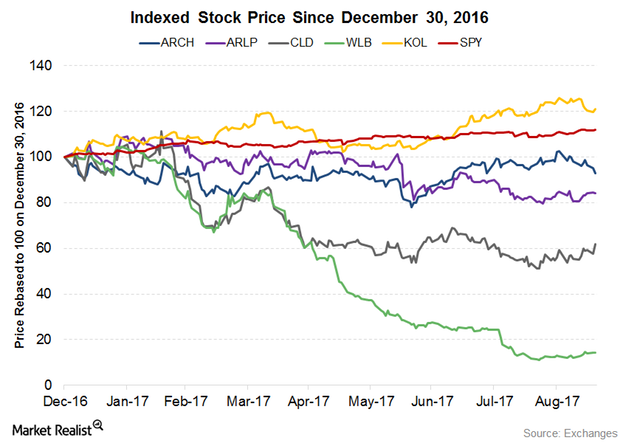

What Factors Could Drive Arch Coal Stock in 2H17?

1H17 in review Majority of the coal (KOL) stocks began 2017 on a weak note. The stocks have not been able to recoup from the slump until now. They have been outperformed by the broader market and the VanEck Vectors Coal ETF so far in 2017. On September 19, 2017, Arch Coal (ARCH) has fallen […]

Westmoreland Coal’s Canadian Operations: An Overview

Westmoreland’s Canadian operations Westmoreland Coal (WLB) acquired seven surface mines in Alberta and Saskatchewan, a stake in an activated carbon plant, and a char plant in Canada from Sherritt International in 2014. As of January 1, 2016, WLB’s Canadian operations are grouped as one entity, Prairie Mines & Royalty ULC. Its Canadian operations hold total […]

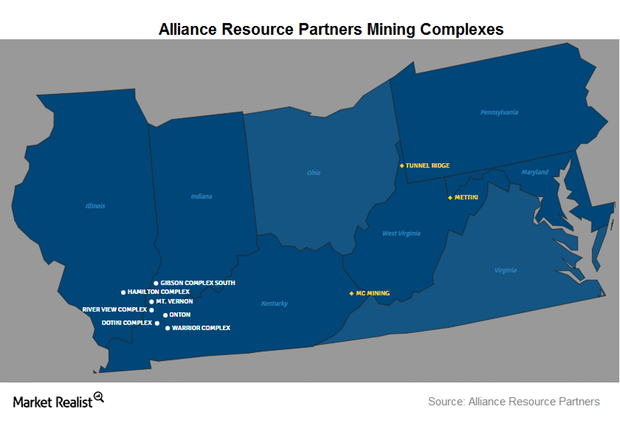

Inside Alliance Resource Partners’ Mining Operations

Alliance Resource Partners (ARLP) operates eight underground mining complexes in two regions: Illinois and Appalachia.Materials Must-know: ANR’s thermal coal business in 3Q14

ANR produces thermal coal from its mines in the Appalachian and Powder River Basin (or PRB). The company had around three billion tons of thermal coal reserves.

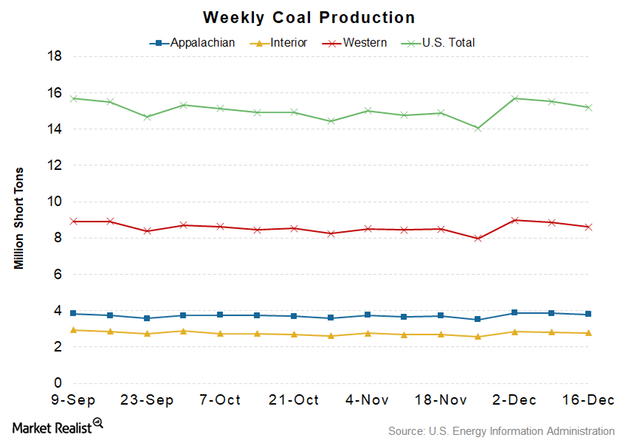

Coal Production Continues to Fall

On December 21, the EIA released the estimate of the coal volumes produced in the US for the week ending December 16.

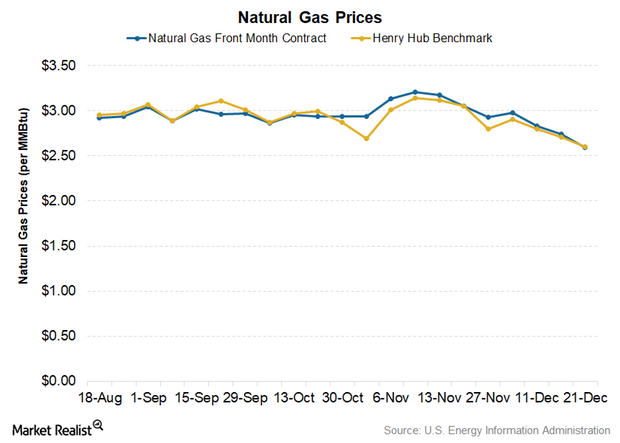

Natural Gas Prices Continue to Fall

In the EIA’s STEO report, it predicted that the Henry Hub natural gas benchmark price would average $3.12 per MMBtu in 2018.

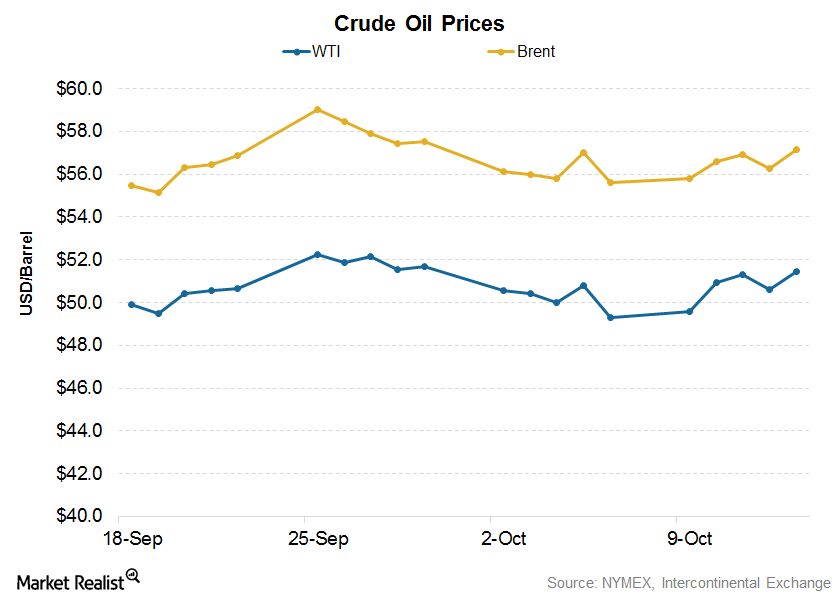

How Higher Crude Oil Prices Impact Coal Producers

On October 13, 2017, Brent crude oil prices settled at $57.17 per barrel, 3% higher than $55.60 reported during the previous week.

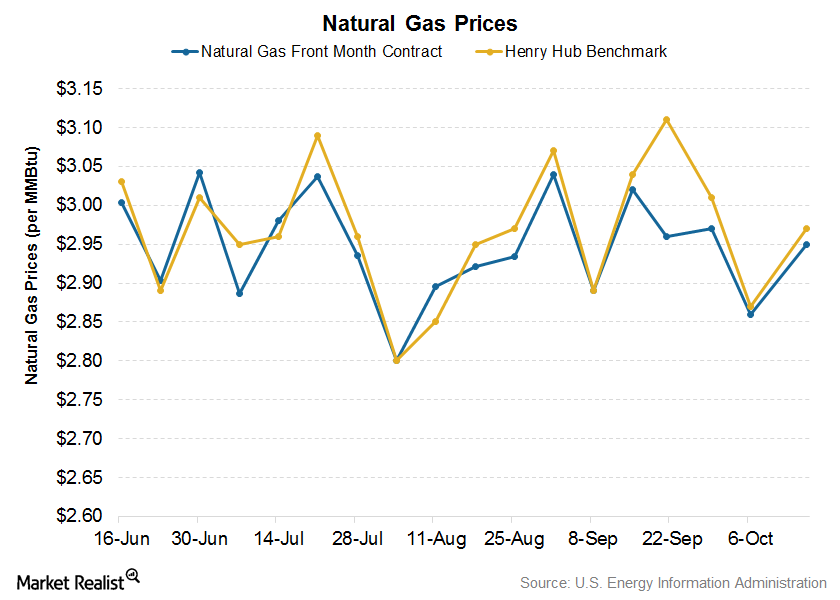

How Weather Affects Natural Gas Prices

On October 16, the November US natural gas futures contract price was reported as $2.95 per MMBtu.Company & Industry Overviews An Overview of Westmoreland Coal

In this series, we’ll analyze Westmoreland Coal’s (WLB) business model. We’ll explore how the company has expanded its business, and evaluate its key operational metrics and financial position.

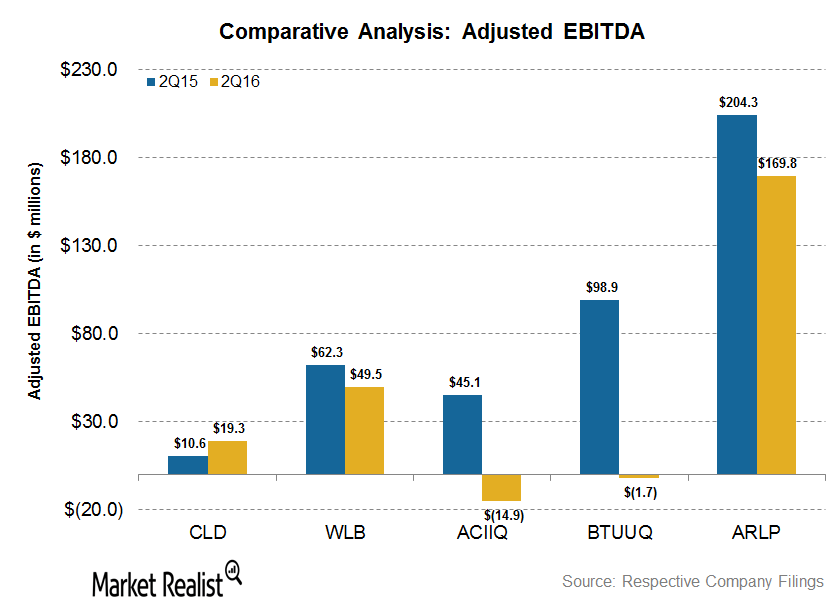

Cloud Peak Energy Topped EBITDA Margin Growth in 2Q16

Cloud Peak Energy reported positive growth in its 2Q16 EBITDA margins. Cloud Peak Energy’s EBITDA margins came in at 11.1% in 2Q16.