Workday Inc

Latest Workday Inc News and Updates

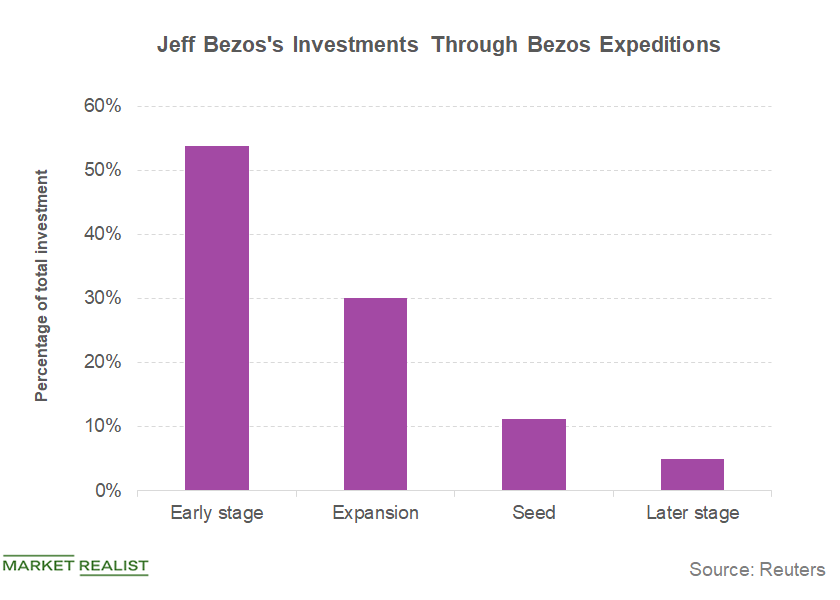

Why Jeff Bezos Loves Startups

According to the data compiled by Thomson Reuters, early-stage companies make up ~53.8% of Bezos Expeditions’ total investments.

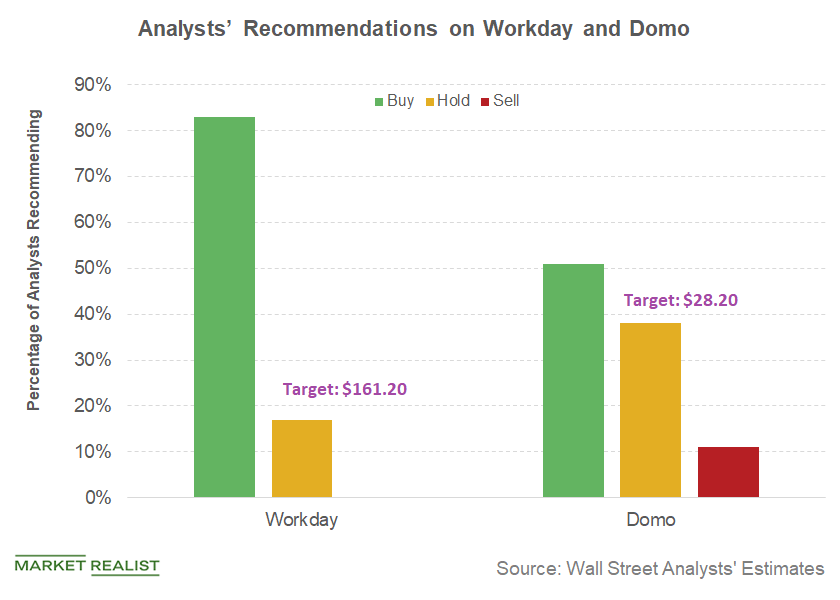

How Jeff Bezos’s Workday and Domo Investments Fared in 2018

Twitter stock surged by about 73% in the first trading day after its IPO to $44.90.

Should You Follow Jeff Bezos and Invest in Uber and Airbnb IPOs?

Bezos invested about $37 million in the American ride-hailing service provider Uber in 2011.

Get Real: Tesla Bears and the ‘Tariff Man’

The Dow Jones Index needs a Santa Claus rally this year. Instead, the Dow Jones might have to contend with the “Tariff Man.”

Adobe, Workday, and ServiceNow Fall Due to Downgrades

Adobe (ADBE), Workday (WDAY), and ServiceNow shares have lost significant market value in early-market trading today. Adobe stock has fallen close to 4%.

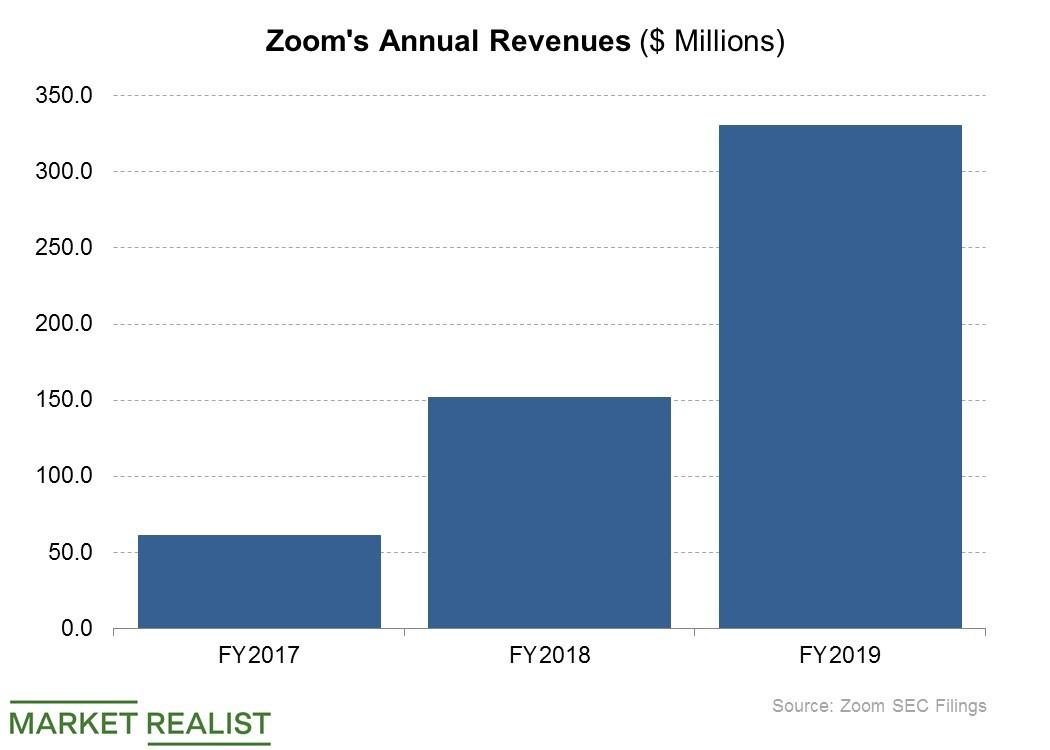

A Look at Zoom’s Most Prominent Customers

Zoom Video Communications (ZM) serves customers of all sizes, from sole businesses to Fortune 50 organizations.

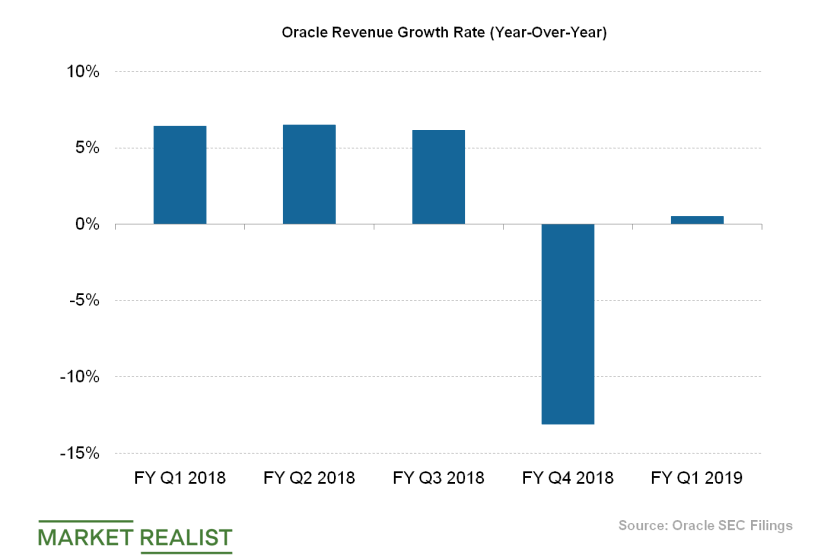

Why Oracle’s Revenue Growth Is Getting Sluggish

Software giant Oracle (ORCL) topped revenue estimates of nearly $9.62 billion by 0.3% in the third quarter of fiscal 2019.

Why Oracle Considers the AT&T Deal One of the Biggest

Last year, Oracle and AT&T entered into an agreement through which Oracle will migrate thousands of existing Oracle databases on AT&T’s network to Oracle cloud.

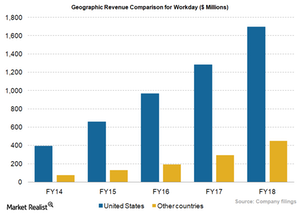

Workday Generates Strong Business Growth outside the US

In the last five years, Workday’s international business grew at a CAGR (compound annual growth rate) of 57%.

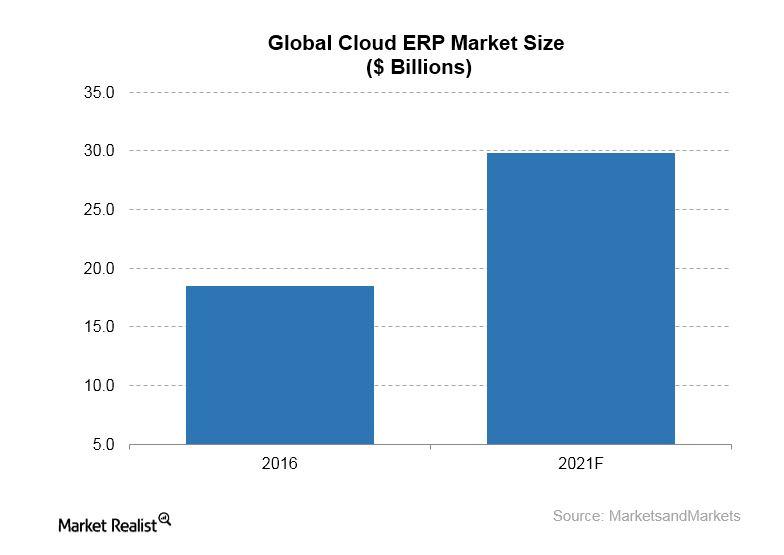

A Look at Oracle’s Cloud Enterprise Resource Planning Prospects

According to a new report by research firm MarketsandMarkets, the global enterprise resource planning (or ERP) market is set to expand at a healthy annual rate in the next few years.

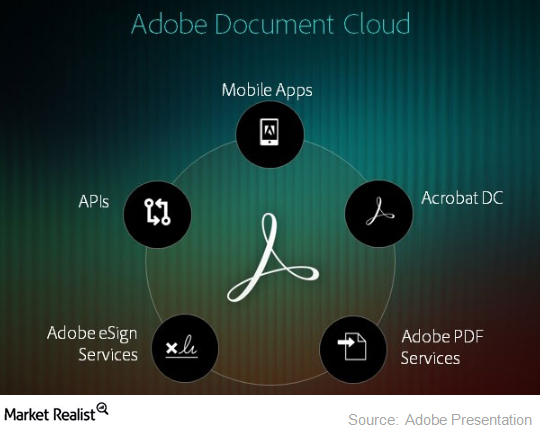

How Adobe’s Document Cloud Contributed to Its Fiscal 3Q16 Results

Adobe’s Document Cloud performance in 3Q16 So far in this series, we’ve discussed Adobe’s (ADBE) performance in fiscal 3Q16. We also looked at Adobe’s increased Creative Cloud subscriptions, which enabled the company’s Digital Media segment to report a 29% revenue growth in fiscal 3Q16. Document Cloud (or DC) also contributed to Digital Media’s record revenue […]